name and background<

spanstyle="font-size: inherit"> full name: Bank Massad Ltd. (Hebrew: בנק מסד בע"מ)

founded: 1929, originally founded as Massad Mutual Loans and Savings Company (Hebrew: מסד חברה הדדית להלוואות וחסכונות בע"מ); In 1977 it was reorganized into the modern Bank Massad.

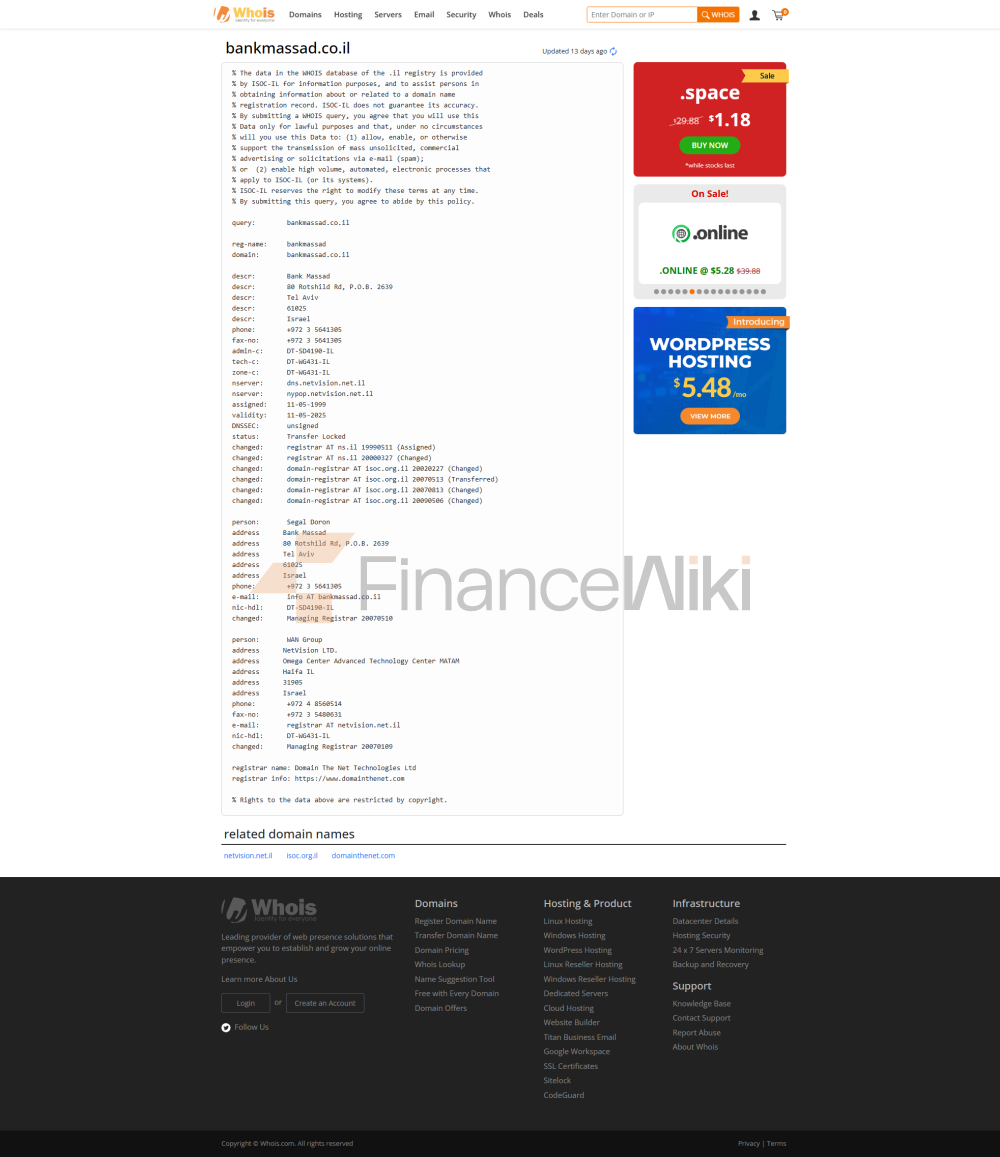

Headquarters location: 12 Abba Hillel Street, Ramat Gan, Israel at the Stock Exchange Complex (previously located at 80 Rothschild Avenue, Tel Aviv).

Shareholder Background: The bank is jointly owned by First International Bank of Israel Ltd. (FIBI, 51%) and the Israeli Teachers' Union (Histadrut HaMorim). FIBI is one of Israel's leading commercial banks, and its shares are partly held by government and private investors. Bank Massad is not publicly listed on the Tel Aviv Stock Exchange and operates in a model that combines the international resources of the parent company with the community orientation of the teachers' union. In 1977, due to financial instability and the death of the CEO, Bank Hapoalim briefly took a controlling stake and later transferred part of its stake to Masad Holdings, which was held by the original institutional members.

service scope

coverage area:Bank Massad serves the whole of Israel, covering Tel Aviv, Jerusalem, Haifa, Ramat Gan, Nahariya and other cities, with outlets especially in communities where educators are concentrated. The bank supports cross-border financial services through international systems such as SWIFT, Visa, MasterCard, etc., and cooperates with major banks around the world without overseas branches.

Number of offline branches: By 2025, the bank has 21 branches in major Israeli cities and educational communities, such as Shamai Street in Jerusalem and Israel Bar Yehuda Road in Haifa.

ATM distribution: The number of ATMs operated by banks is not disclosed, located near branches, business districts, and educational institutions, and supports cash deposits, contactless payments, and cardless withdrawals.

services and products

Bank Massad offers a wide range of financial services to individuals (especially teachers and educators), SMEs and corporate customers, with product lines including:

Corporate Banking: provides business loans, trade finance (letters of credit, guarantees), cash management and payroll program services to SMEs. Banks support the financing needs of education-related businesses and non-profit organizations.

e-banking: provides account management, real-time transfers, bill payments and loan application services through online banking and mobile apps.

payment services: support international money transfers (e.g., Western Union, Remitly), POS terminal payments, and contactless payments to serve the daily transaction needs of the education community.

> personal banking: Savings accounts, fixed deposits, personal loans, mortgages, credit cards (Visa, MasterCard), debit cards, foreign exchange services and investment advice. Featured services include preferential loans and savings plans tailored for teachers.

regulatory and compliance<

span style="font-size: inherit"> regulators:Bank Massad is regulated by the Bank of Israel and follows the Israel Banking Law and international financial standards such as the Basel Accord.

Deposit Insurance Program: The bank participates in the Israel Deposit Insurance Program to protect customer deposits, the exact amount of which is not disclosed.

Recent compliance record: The bank has a good compliance record and no major violations. Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations are strictly enforced, are regularly audited by Israeli banks, and the risk management system is in line with international standards.

digital service experience<

span style="font-size: inherit">App & Online Banking: Bank Massad, which offers a mobile app and online banking platform (accessed via www.bankmassad.co.il), has a rating of about 3.8 stars (Google Play and App Store, out of 5 stars) and has been praised for its simplicity and customization of services for educators, but it has been slow to update its technology.

core features:

face recognition: not explicitly supported , the login mainly relies on passwords and SMS verification.

real-time transfers: supports domestic and international transfers, and provides cross-border services through the SWIFT system (code MASBILITXXX).

bill management: supports paying utility bills, mobile phone recharges, and insurance premiums.

investment tool integration: provides basic investment advice, does not support stock or fund trading at this time.

technical innovation:

Open Banking API: The open banking API has not been developed, and the digital service is relatively basic.

Card-not-present withdrawals: may support the generation of ATM codes through the mobile app for ATM operation.

> AI customer service : AI customer service is not explicitly provided, and customer support is mainly through phone and human service.

customer service

Bank Massad offers multi-channel customer service to meet the needs of educators and corporate customers:

Phone: Customer Hotline*2446 or + 972-3-7172446 for business hours support.

email: Submit an inquiry through the official website or contact the support team directly.

Live chat: Online banking and mobile apps offer limited live chat functionality.

branch services: 21 branches provide face-to-face consultations, working hours from Monday to Friday from 9:00 to 14:30, and some branches are extended to 18:30 on Tuesdays and Thursdays.

security measures

Bank Massad uses a multi-layered security mechanism:

Anti-Money Laundering & Anti-Fraud: Comply with the AML/CFT requirements of Israeli banks, monitor suspicious transactions, and conduct regular risk assessments.

transaction security: online banking supports one-time verification codes for large-value transfers, reducing risks.

Physical security: Branches and ATMs are equipped with surveillance systems and security personnel.

> network security: using SSL encryption and multi-factor authentication (password + SMS verification), customer data is anonymized.

featured services and differentiation

Bank Massad is unique in the Israeli banking industry with its educational community expertise and heritage:

Heritage: Since its establishment in 1929, it has accumulated a deep community trust for nearly 100 years.

FIBI support: As a FIBI subsidiary, it shares its international resources and provides efficient cross-border financial services.

SME financing: Supporting education-related businesses and non-profit organizations to support regional economic development.

> Teacher Community Services: Customized loans for teachers and educators, Savings and insurance products trusted by the education community.

summary

Bank Massad, Israel's joint venture commercial bank, occupies a unique position in financial services in the education sector through its dedicated service to the teacher community and its support of FIBI. Its 21 branches and digital platform cater to the needs of individuals and SMEs, and its solid financial performance and community trust make it a reliable financial partner for educators, despite a slight lag in technological innovation. For teachers or education-related businesses looking for customized financial services, Bank Massad is a trusted choice.