name and background

full name: Israel Discount Bank of New York (registered as IDB Bank)

founded: 1949, initially as the New York representative office of Israel Discount Bank; In 1962, the first full-service branch was opened; In 1980, it became a wholly owned subsidiary of Israel Discount Bank Ltd.

Headquarters location: 1114 Avenue of the Americas, W. R. Grace Building, New York City, United States

Shareholder Background: IDB Bank is wholly owned by Israel Discount Bank Ltd., a public company listed on the Tel Aviv Stock Exchange (symbol: DSCT) with major shareholders including the Israeli government and private investors. IDB Bank itself is not independently listed, relying on the international resources and brand influence of the parent company to operate, focusing on localized services in the US market.

service scope

Regions Covered: IDB Bank primarily serves the United States, covering New York, New Jersey, California and Florida, as well as representative offices in Latin America (Chile, Uruguay) and Israel to support cross-border financial services. The bank works with international banks through the global network of the parent company to provide efficient cross-border transaction services, with no overseas full-service branches.

Number of offline branches: By 2025, the bank has seven full-service branches in New York (Manhattan, Brooklyn, Staten Island), New Jersey (Short Hills), California (Los Angeles, Beverly Hills) and Florida (Aventura).

ATM distribution: The number of ATMs is limited, the specific data is not disclosed, mainly located near branches and business districts, and supports cash deposits and withdrawals and contactless payments.

services and products

IDB Bank is a high-net-worth individual, Family offices and corporate clients offer high-end financial services to a portfolio of private banks ><

ul style="list-style-type: disc" type="disc">commercial banking: commercial lending to corporations, real estate financing (recent examples include a $51 million multi-family residential portfolio loan in Los Angeles and a $31 million bridge loan for the Newark Art Project), trade finance, cash management, deposit services, and foreign exchange transactions.

Capital Markets Services: Brokerage, securities trading and investment banking services through IDB Capital, covering U.S. and international markets.

e-banking: provides account management, real-time transfers, bill payments and loan application services through online banking and mobile apps, especially for international customers to manage cross-border accounts.

regulatory and compliance

Regulators: IDB Bank is regulated by the New York State Department of Financial Services (DFS) and supervised by the Federal Deposit Insurance Corporation (FDIC), following the U.S. Banking Act and international financial standards such as Basel.

Deposit Insurance Program: The bank is a member of the FDIC and is insured up to $250,000 per customer deposit.

recent compliance record: The bank has a good compliance record and no major violations. Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations are strictly enforced, and are regularly reviewed by DFS and FDIC.

digital service experience<

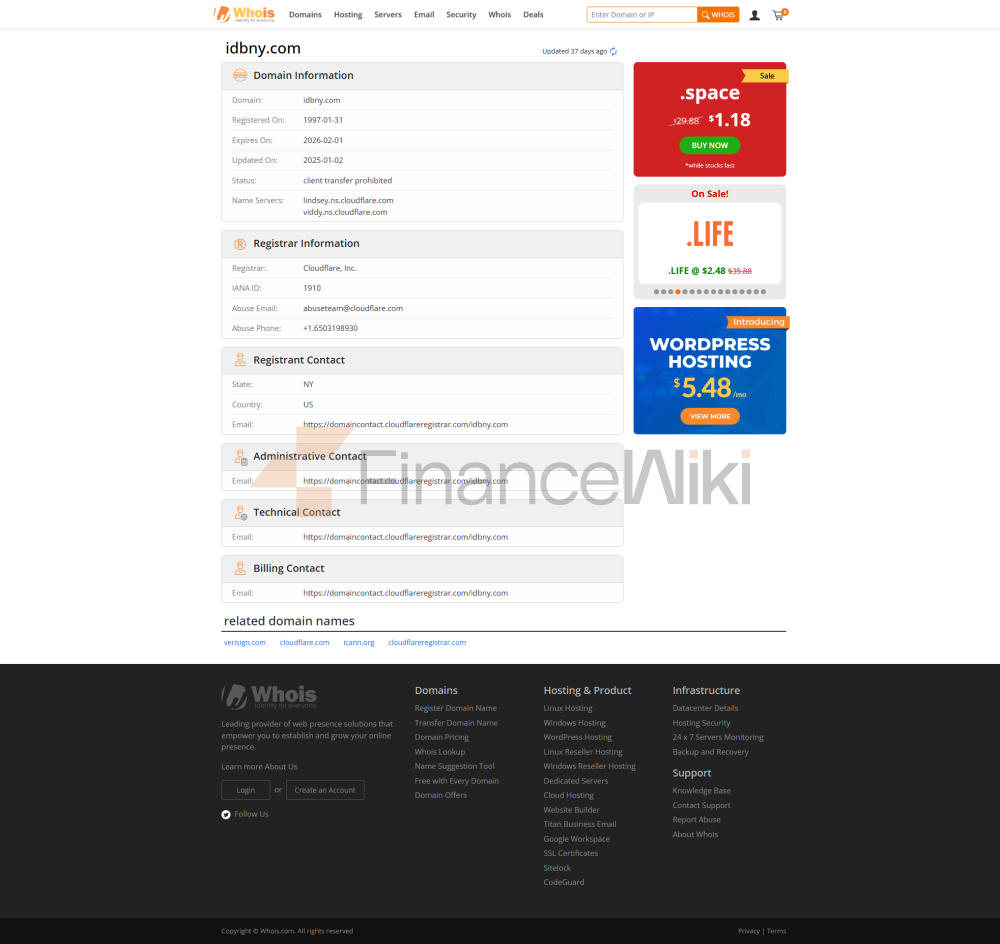

span style="font-size: inherit">App & Online Banking: IDB Bank's mobile app and online banking platform (accessed via www.idbny.com) have a rating of around 4.0 stars (Google Play and App Store, out of 5 stars), and are well received for their high-end customer orientation and user-friendly interface, but are slightly less feature-rich than large banks.

core features:

real-time transfers: supports domestic and international transfers, and provides cross-border services through the SWIFT system (code IDBBUS33).

bill management: supports paying utility bills and enterprise bills.

integration of investment instruments: Provide investment management and asset allocation tools through IDB Lido Wealth, and connect to securities trading platforms.

> face recognition: Supports fingerprint and face recognition login to enhance security.

technical innovation:

Open Banking API: Open banking APIs are being explored to enhance third-party payment integration.

IDB Lido Wealth: A joint venture established in 2021 to provide digital wealth management services to high-net-worth clients and institutions.

> AI customer service : AI customer service is not explicitly provided, but online banking supports real-time digital assistance.

customer service

IDB Bank offers multi-channel customer service with a focus on personalization:

Phone: Customer Hotline +1-212-551-8500 for round-the-clock support.

email: Submit an inquiry through the official website or contact the account manager directly.

Live chat: Online banking and mobile apps provide live chat capabilities to quickly respond to high-end customer needs.

Branch service: 7 branches provide face-to-face consultation, working hours are Monday to Friday 9:00-16:00, and some branches extend service.

security measures<

spanstyle="font-size: inherit">IDB Bank adopts a multi-level security mechanism:

Anti-Money Laundering & Anti-Fraud: Monitor suspicious transactions and conduct regular risk assessments in accordance with DFS and FDIC AML/CFT requirements.

transaction security: A one-time verification code is required for large-value transfers to reduce the risk of unauthorized transactions.

Physical security: Branches and ATMs are equipped with surveillance systems and security personnel.

> network security: SSL encryption, multi-factor authentication (face/fingerprint + password), customer data is anonymized.

featured services and differentiation

IDB Bank is unique in the highly competitive U.S. market thanks to its international background and high-end services:

Cross-border finance: Leverage the parent company's global network to support cross-border transactions for clients in the United States, Latin America, and Israel.

Real Estate Financing: Providing large real estate loans in markets such as New York and Los Angeles, most recently including a $51 million multifamily portfolio loan.

75 years of history: operating since 1949, with deep market experience and customer trust.

> Private banking expertise: through IDB Lido Wealth provides customized wealth management and family office services to high-net-worth clients.

summary

As a wholly owned subsidiary of Israel Discount Bank Ltd., IDB Bank occupies a unique position in the U.S. market with its expertise in private banking and commercial banking. Its 7 branches and digital platform meet the diverse needs of high-net-worth individuals and corporate clients, especially in the cross-border financial and wealth management sectors. Despite its small size, its solid financial performance, international resources and personalized service make it a reliable choice for high-end clients.