OverviewFull

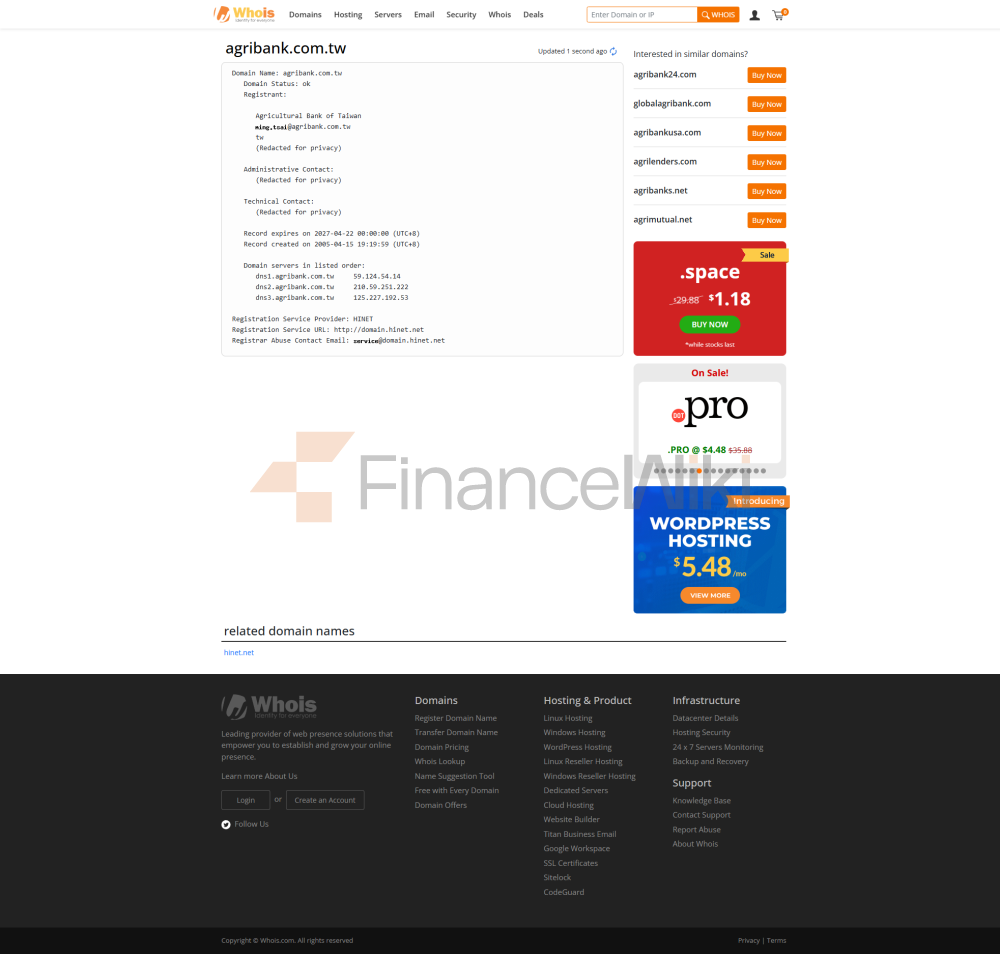

Name: Agricultural Bank of Taiwan

Founded: 2005Headquarters

Location: Taipei,

TaiwanShareholder Background: Agricultural Bank of Taiwan is a state-owned bank, wholly owned by the Taiwanese government, and has strong ties to the public sector related to the Taiwanese government. The bank focuses on promoting the development of Taiwan's agricultural and rural economy, and is committed to providing financial services to agriculture and farmers.

coverage:

Number of offline outlets in Taiwan: Agricultural Bank of Taiwan has many branches throughout Taiwan, which is convenient for farmers and ordinary people to handle various financial services.

ATM distribution: As an important part of traditional banks, Agricultural Bank of Taiwan has set up an extensive ATM network in major cities and rural areas in Taiwan to facilitate customers to withdraw money and make deposits.

Regulation &

ComplianceABC of Taiwan is strictly regulated by Taiwan's financial regulators, including

Central Bank of Taiwan (CBC): formulates and adjusts Taiwan's financial policies.

Taiwan Financial Supervisory Commission (FSC): Responsible for the day-to-day supervision, business licensing and compliance of the banking industry.

ABC strictly abides by local financial regulations and compliance requirements, and has joined Taiwan's deposit insurance program to protect customers' deposits.

Recent Compliance Record: The Agricultural Bank of Taiwan maintains a good compliance record and has not had any major violations of financial regulations.

financial healthCapital

adequacy ratio: The capital adequacy ratio of the Agricultural Bank of Taiwan remains at a stable level, which meets the requirements of the regulator and has a strong ability to resist risks.

Non-performing loan ratio: The bank's loan quality is relatively good, and the non-performing loan ratio is relatively low, indicating its good risk control ability.

Liquidity Coverage Ratio: The bank's liquidity coverage ratio is up to standard, which can effectively respond to customers' capital needs and sudden market changes.

product

personal financial services

NTD DepositABC

of Taiwan provides a variety of NTD deposit services to individual customers, including demand deposits, time deposits, checking deposits and high-yield savings accounts. Clients can choose from different deposit tenors and interest rates to facilitate the management of their personal funds.NTD lending

banks provide various NTD loan services to individual customers, including housing loans, car loans, personal credit loans, etc. Loan interest rates are customized based on factors such as loan amount, credit status, and flexible repayment options.Foreign exchange

businessAgricultural Bank of Taiwan provides foreign exchange trading services for individual customers, customers can carry out foreign currency deposits, foreign exchange and other operations. The bank's foreign exchange business supports multiple currency exchanges and provides real-time exchange rate information.Trust business

bank provides trust services, and customers can carry out wealth management and asset inheritance through trust business. There are a variety of trust products, covering the needs of customers with different risk appetites.

As one of the bank's characteristic services, the Agricultural Bank of Taiwan provides gold trading services. Customers can buy gold, save for gold or invest in gold-related products to cope with market volatility.Project Agricultural Loan

BusinessThe bank provides loan services for agricultural projects, including loan products for agricultural enterprises and farmers' cooperatives, to support agricultural development and rural economic construction.Agricultural Gold Card

is a special financial card launched by the Agricultural Bank of Taiwan for agricultural customers, providing basic financial services such as deposits, withdrawals, transfers, etc., and has specific agriculture-related discounts.Foreign Exchange Rate BillboardsThe

Agricultural Bank of Taiwan has set up foreign exchange rate billboards through its branches to provide customers with real-time exchange rate information and help customers grasp the dynamics of the foreign exchange market.Smart Application

Bank provides online smart application services, which allow customers to submit applications for loans, credit cards, etc., through the bank's official website or mobile app, and enjoy more convenient financial services.

corporate financial services

corporate lending

Agricultural Bank of Taiwan provides various loan services for enterprises, including short-term loans, long-term loans, revolving credit loans, etc., to help enterprises solve capital turnover problems and support their development and growth.Policy Loan ZoneFor

enterprises that are in line with government policies, the Agricultural Bank of Taiwan provides a special policy loan zone. The service provides SMEs with favorable loan terms to support their innovative development and social contribution.Project Agricultural Loan BusinessFor

agricultural enterprises or agriculture-related projects, the Agricultural Bank of Taiwan provides specific agricultural project loans. This service aims to support the upgrading of the agricultural industry and the development of the rural economy.

In addition to providing foreign exchange business for individual customers, the bank also provides foreign exchange management services for corporate customers, including cross-border payment, foreign currency financing, etc., to help enterprises expand their global business.Guarantee businessAgricultural

Bank of Taiwan provides guarantee business for enterprises, including guaranteed loans, performance guarantees, etc., to help enterprises improve their credit, ensure the smooth flow of funds and the smooth implementation of projects.

digital service experience

APP and online banking:

User Ratings: The mobile banking app of the Agricultural Bank of Taiwan has received relatively positive reviews on major app stores (e.g., App Store, Google Play).

Core functions: The bank's APP supports users to log in through face recognition, make real-time transfers, and manage bills.

Technological innovation: Banks have adopted AI-powered customer service and are gradually introducing robo-advisory services to further enhance the digital experience for customers.

Open banking API support: Some services now support open banking interfaces, making it easier for developers and third-party companies to access banking services within the compliance framework.

customer service

quality service channel: The Agricultural Bank of Taiwan provides round-the-clock telephone support and has set up an online customer service function on its official website to ensure that customers can get help at any time.

Complaint handling: Banks have a low complaint rate, high complaint handling efficiency, short average resolution time, and high user satisfaction.

Multi-language support: The bank provides Chinese and English services to facilitate communication between domestic and foreign customers.

With its deep historical background, strong government support, and solid service foundation, the Agricultural Bank of Taiwan has successfully occupied a place in Taiwan's banking industry. With a focus on agricultural and rural financial services, the bank is committed to providing strong support to farmers and agribusinesses. With the advancement of digital transformation, ABC has gradually achieved the deep integration of online and offline services, and further strengthened its competitiveness in the market by launching a series of innovative products and services.