Basic information

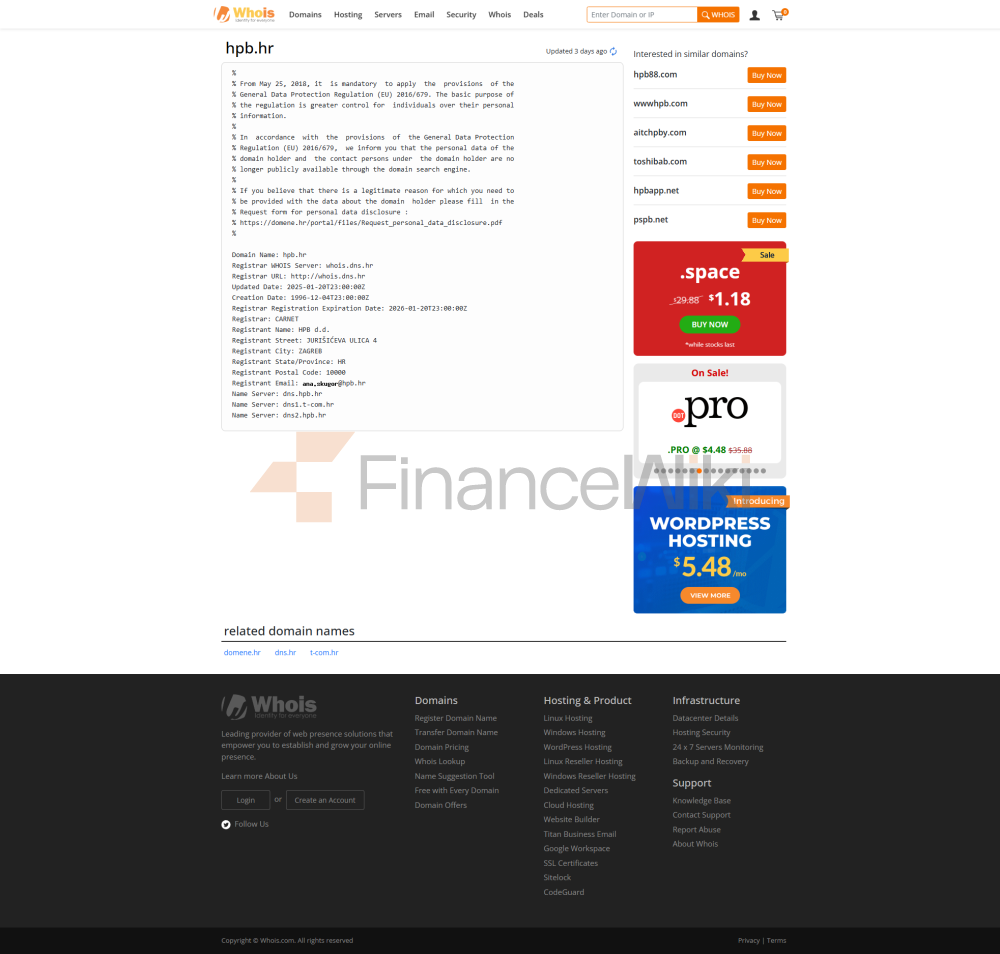

about the bank Hrvatska poštanska banka d.d. (HPB) is a commercial bank with a significant state-owned background. Founded in October 1991 and headquartered in Zagreb, Jurišićeva 4, Croatia.

Initially wholly owned by the Croatian Post (Hrvatska pošta), the Croatian government became the main shareholder until 2001 through the State Fund and the National Pension Fund. Currently, the Croatian government directly or indirectly holds 77% of the shares, the remaining shares are held by private shareholders, and the bank is listed on the Zagreb Stock Exchange (ticker symbol: HPB).

HPB is positioned as the largest local bank in Croatia, ranking fifth in the country in terms of assets in 2024, with a market share of 9.37%, mainly serving small and medium-sized enterprises and retail customers, emphasizing localization and social responsibility.

Scope of Services

HPB mainly serves the whole territory of Croatia, covering urban and remote areas, and has built the most extensive financial service network in the country through cooperation with Croatian Post. As of 2024, HPB has 57 branches, 12 regional centers, and provides basic banking services at more than 200 postal outlets through the Post Office Banking program.

The ATM network covers an extensive network, with more than 1,500 cash withdrawal points that support fee-free cash withdrawals, which greatly facilitates customers, especially those in rural areas. HPB's services are mainly in the domestic market, and there is no significant global business expansion for the time being.

Regulation & Compliance

HPB is directly supervised by the Croatian National Bank (Hrvatska Narodna Banka) and the European Central Bank (ECB) and has been listed as an "Important Institution" under the European Banking Regulatory Framework since 2020. The bank participates in the Croatian Deposit Insurance Program, which guarantees the security of deposits of up to 100,000 euros (about 750,000 Croatian kuna) per depositor.

With a strong recent compliance track record and no major violations, HPB has demonstrated strong compliance capabilities through robust operations and a privatization restructuring in 2015, which was further enhanced by the merger with Jadranska banka and HPB-Stambena štedionica in 2019.

Financial Health

HPB demonstrated solid financial performance. In 2024, the capital adequacy ratio will be about 17.5%, far exceeding the Basel Accord requirement of 8%, showing strong risk resistance. Non-performing loan ratio (NPL) data is not publicly available, but according to industry analysis, the Croatian banking sector as a whole has a low NPL, and HPB is expected to perform better than average as a leading bank.

The loan-to-deposit ratio (L/D) was 40.19%, indicating sufficient liquidity and a healthy balance sheet. The liquidity coverage ratio (LCR) is not clearly disclosed, but HPB's assets grew by 11.87% and its return on equity (ROE) reached 13.47% in 2024, reflecting its efficient capital utilization and stable profitability.

Deposits & Loans

Deposits: HPB offers a variety of deposit products, including current accounts, time deposits, and high-yield savings accounts. The interest rate on demand accounts is lower (about 0.01%-0.5%), and the interest rate on fixed deposits varies depending on the currency and maturity, for example, the interest rate for 12-month time deposits in euros is 1.4%, 1.3% for 24-month and 36-month deposits, and the interest rates for deposits in US dollars and pounds are lower (0.01%-0.03%). Featured products include children's savings accounts and combined savings plans, which are suitable for long-term savers. Large certificates of deposit (CDs) are relatively limited and are mainly presented in the form of time deposits.

Loans: HPB provides mortgages, car loans, consumer loans, and student loans. Mortgage interest rates are competitive, such as the government-subsidized mortgage rate introduced in 2019 as low as 2.09%, depending on the customer's credit rating. Car loans and personal lines of credit typically range from 3%-7%, depending on the loan amount and term. HPB supports flexible repayment options, such as no penalty for early repayment, adjustment of repayment plan, etc., which is especially suitable for customers with stable income.

List of Common Fees

HPB's fee structure is relatively transparent, but it is important to be aware of potential costs. Current accounts are usually free of monthly fees, and some accounts require a minimum balance to avoid fees (depending on the account type). Domestic transfers are free of charge via online or mobile banking, and the over-the-counter transaction fee is approximately 2 Croatian kuna per transaction. Cross-border transfer fees are higher, depending on the amount and the target country, and it is advisable to use SEPA payments to reduce costs.

ATM withdrawals are free of charge within HPB and postal networks, and interbank withdrawals may be subject to a 1-2% handling fee. Overdraft fees are based on the account agreement and are typically the daily interest rate plus a fixed penalty. Hidden Fee Warning: Some fixed deposits may face interest losses when withdrawn early, so it is recommended to read the terms carefully.

Digital service experience

HPB's mBanking and eBanking are highly regarded as "state-of-the-art mobile banking services" in the Croatian market. The user rating is around 4.0/5 on the App Store and Google Play, reflecting a high level of user satisfaction. Core features include facial recognition login, real-time transfers, bill management, and portfolio tracking.

Featured services such as cardless ATM cash withdrawals (eCash) allow users to withdraw money via QR code or one-time password with a daily limit of CHK 4,000. HPB supports open banking APIs, allowing third-party fintech companies to access, improving service flexibility.

In terms of technological innovation, HPB provides basic AI customer service functions, and robo-advisory services are still developing, which are more used for investment fund recommendations rather than complex wealth management.

Quality of customer service

HPB offers 24/7 telephone support (toll-free hotline: 0800 472 472) Monday to Friday from 8:00-20:00 and Saturday from 8:00-16:00. The live chat function is available through online and mobile banking, and the response time is usually less than 5 minutes. Social media (Facebook, LinkedIn) are very responsive, with an average response time of about 1 hour.

The complaint rate is low, most problems (such as transaction disputes) are resolved within 24-48 hours, and user satisfaction is high.

HPB supports multi-language services, including Croatian, English, and some German interfaces, and is suitable for cross-border customers or foreign residents, but non-English language options are more limited.

Safety and security measures

HPB participates in the Croatian Deposit Insurance Scheme, which guarantees the safety of deposits up to €100,000. Anti-fraud technology includes real-time transaction monitoring, two-factor authentication (2FA), and anomalous behavior alerts, significantly reducing the risk of phishing emails and account takeovers. HPB is ISO 27001 certified for information security and its data management is compliant with the EU GDPR standard.

In recent years, no major data breaches have been reported, demonstrating strong data protection capabilities. Online and mobile banking use 256-bit encryption technology to ensure the security of transactions.

Featured Services and Differentiation

Market segments: HPB provides fee-free current accounts for students, suitable for young users; Exclusive wealth management products for the elderly include high-yield savings plans, combined with pension insurance services; There are few green financial products, but HPB supports ESG investment funds to cater to the trend of sustainable development.

High Net Worth Services: HPB's private banking services are aimed at high-net-worth clients, providing customized wealth management and investment advice, with an entry threshold of approximately €500,000 in assets. Services include a dedicated financial advisor and priority transaction processing.

HPB has also demonstrated an innovation-driven brand image by supporting fintech start-ups through events such as the "Fintech Hackathon".

Market Position & Accolades

HPB is the fifth-largest bank in Croatia, with total assets of approximately €7.9 billion in 2024, a deposit market share of 10.22% and a loan market share of 5.68%. Globally, HPB is small and does not enter the "Top 50 Banks in the World", but has an important presence in the Croatian home market.

In 2019, HPB received the "Best Commercial Bank in Croatia" award from International Banker for its digital transformation and market performance. In 2023, HPB won a regional fintech award for mobile banking innovation, highlighting its leadership in the technology sector.