basic bank information

Israel Credit Cards-Cal (Cal for short) is a joint venture commercial bank known for its innovative digital financial services and extensive customer base as Israel's leading credit card issuer and clearing institution. Jointly owned by Israel Discount Bank and First International Bank of Israel, Cal focuses on non-bank credit products and payment solutions to provide flexible financial services to individual and corporate customers.

name and background

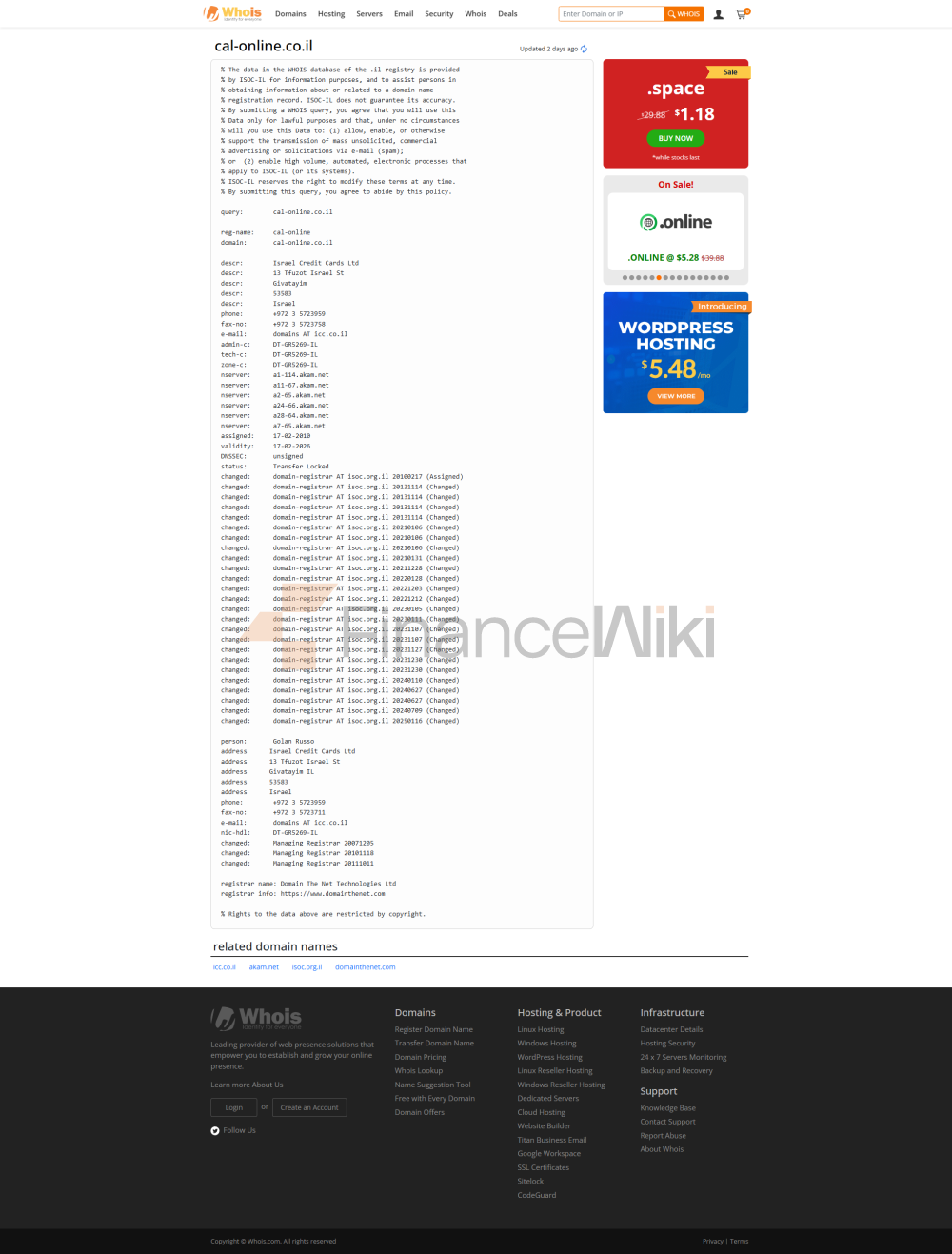

full name: Cal - Israel Credit Cards Ltd. (Hebrew: ישראכרט קל)

founded in 1970 by Israel Discount Bank, has since expanded its business scope.

Head office: 13 Tefuzot Israel Street, Givatayim, Israel (operational office is located at Bnei Brak, Masada Street, 3).

Shareholder Background: Cal is jointly owned by Israel Discount Bank (72%) and First International Bank of Israel (28%). Israel Discount Bank is a public company listed on the Tel Aviv Stock Exchange (symbol: DSCT) and its major shareholders include the Israeli government and private investors. CAL itself is not independently listed, and operates on the resources and brand influence of the two major banks. In 2023, Cal was acquired by Clal Insurance Enterprises Holdings as a wholly owned subsidiary, further strengthening its competitiveness in the financial services sector.

services and products

Cal focuses on credit card issuance, Clearing and non-bank credit services to provide a diverse range of financial instruments for individual and corporate customers:

Corporate Banking: Clearing services, investment and working capital financing, online prepayments, credit transaction factoring, and POS terminal services for businesses. Support payment solutions for industries such as hotels, airlines, retail, and educational institutions.

payment service: provides an online payment gateway through the CalPay platform, supporting Visa, MasterCard, gh-link card and mobile wallet payments, serving industries such as hospitality, airlines, retail and education. Featured products include the FixBack card, which allows unlimited cashback on purchases to be used on the BuyMe platform.

e-banking: Provides services such as account management, real-time transaction monitoring, credit limit adjustments, loan applications, bill date changes, and lost/stolen card reports through the Cal mobile app and online banking (www.cal-online.co.il).

> personal banking: Issuance of Visa, MasterCard, Diners Club (exclusive marketing by Cal) and IsraCard (liquidated since 2012), non-bank loans (loan tenor of 3-84 months, interest rate of 8.25%-17.9%), credit card installment (CalChoice card allows customers to customize monthly payments), digital wallets (with Google Pay) and rewards programs (such as Fly Card Premium accumulation) Diamonds". Support for online shopping, international transactions, and billing management.

regulatory and compliance

Regulators: Cal is regulated by the Bank of Israel and follows the Israeli Banking Law and international financial standards such as the Basel Accord.

Deposit Insurance Program: Cal does not participate in the Israel Deposit Insurance Program as it primarily provides non-bank credit and credit card services and does not directly involve deposit accounts.

Recent Compliance Record: Cal has a strong compliance record, strict anti-money laundering (AML) and counter-terrorism financing (CFT) regulations, and is regularly audited by Israeli banks. In 2023, Cal was recognized for its compliance in the open banking reform, successfully implementing an API to support fintech data sharing.

digital service experience<

span style="font-size: inherit">App & Online Banking: The Cal mobile app has a rating of around 4.3 out of 5 stars on Google Play and the App Store, and has been praised for its user-friendly interface and real-time transaction features. The online banking platform (www.cal-online.co.il) provides comprehensive credit card management and loan services.

core function:

Real-time transfers: Supports domestic and international transfers, enabling fast payments via the Visa and MasterCard networks.

Bill Management: Provides 18 months of transaction history inquiry, bill date change, automatic deduction control, and real-time cost chart analysis.

investment tool integration: There are no stock or fund investment tools available, but credit line management and loan applications are supported.

> face recognition: Fingerprint login is supported, but face recognition is not explicitly supported.

technical innovation:

Open Banking API: Cal actively responds to the open banking reform and implements API to support fintech data sharing and improve customer experience.

CalPay platform: An innovative payment platform launched in 2025 that enables fast online payments and enterprise applications to reduce time to market.

digital wallet: supports Google Pay for mobile payments in Israel and international markets.

> AI customer service : AI customer service is not explicitly provided, but real-time digital assistance is provided via mobile app and phone.

customer service

Cal offers multi-channel customer service with a focus on quick response and personalized experiences:

email: Submit an inquiry through the official website (www.cal-online.co.il).

Live chat: The mobile app and online banking offer live chat capabilities to quickly process credit card and loan issues.

physical services: Limited face-to-face consultations are available through the offices of Givatayim, Ashdod and Modi'in Illit, Monday to Friday from 9:00-16:00.

> Phone: Customer Hotline*3533 or +972-3-5726444 for round-the-clock support.

security measures<

span style="font-size: inherit">Cal uses a multi-layered security mechanism to protect customer funds and data:

network security: SSL encryption, multi-factor authentication (password + SMS verification), customer data is anonymized.

Anti-Money Laundering & Anti-Fraud: Monitor suspicious transactions in real-time in accordance with the AML/CFT requirements of Israeli banks.

transaction security: support instant freezing of card loss/theft, and online banking requires a one-time verification code for large-value operations.

payment security: The CalPay platform integrates advanced security mechanisms to ensure the security of online payments and settlements.

featured services and differentiations

Cal is unique in the Israeli financial market thanks to its leading position in the field of credit cards and digital payments:

Non-bank loans: Flexible loan products (interest rate 8.25%-17.9%, term 3-84 months) can be applied for without a bank account.

FixBack Card: An innovative cashback card that allows unlimited cashback on purchases for use on the BuyMe platform to increase customer loyalty.

Open Innovation: Partnering with fintech start-ups and third-party vendors to launch award-winning digital solutions.

Social Responsibility: Achieved a Ma'ala ESG Platinum+ rating for social action and support for vulnerable groups.

> the market leader in credit cards: as Visa, The issuer and clearing house of MasterCard, Diners Club and IsraCard, serving more than 2 million cardholders.

summary

Israel Credit Cards-Cal, Israel's leading credit card and non-bank credit institution, offers flexible financial services to individual and corporate customers with its innovative digital platform and extensive payment network. Backed by Israel Discount Bank and First International Bank, it combines open banking APIs and the CalPay platform to meet modern financial needs. Although it does not operate traditional bank branches, its efficient digital services and high-end customer experience make it unique in the Israeli market.