name and backgroundFull

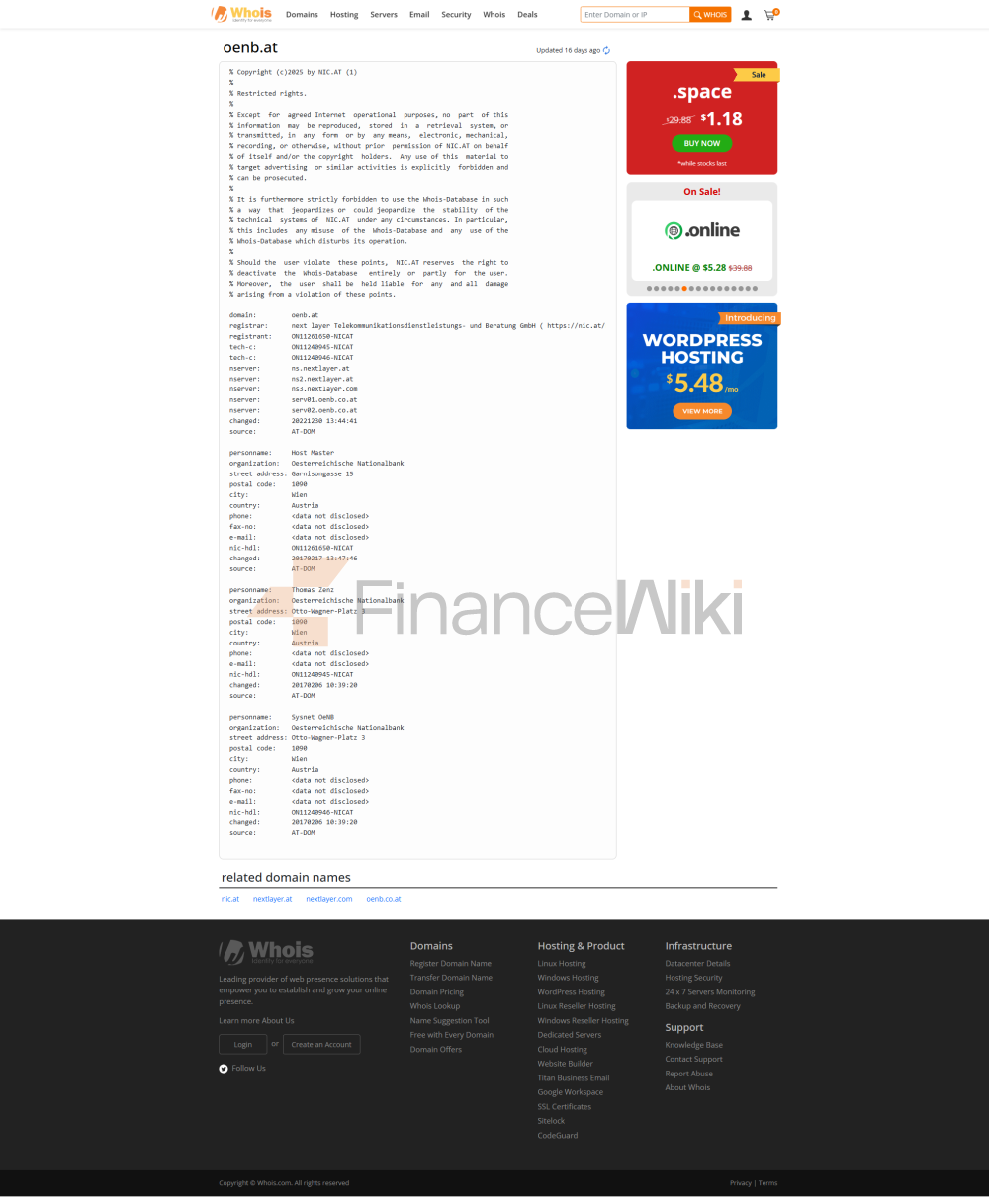

name: Oesterreichische Nationalbank (OeNB)

Founded: 1923 (liquidated in 1938 due to the German-Austrian merger and restored in July 1945)

Headquartered in Otto-Wagner-Platz 3, Vienna, Austria

Shareholder background:

Since May 2010, the €12 million share capital of OeNB has been held exclusively by the Austrian Federal Government, with shareholder rights exercised by the Minister of Finance.

OeNB is a joint-stock company, but subject to special laws, not with the aim of making a profit, but at the service of the national economy and monetary policy.

historical background<

ul style="list-style-type: disc" type="discOrigin: The predecessor of OeNB can be traced back to the Oesterreichische National-Bank, which was established during the Habsburg dynasty in 1816 and is one of the oldest central banks in the world. In 1923 it was reorganized into a modern central bank to meet the needs of the Austrian economy after World War I.

Post-war reconstruction: Liquidated in 1938 as a result of the German-Austrian merger, it played a key role in rebuilding the Austrian economy and stabilizing the currency after its restoration in 1945.

Euro era: Since the adoption of the euro in Austria in 1999, OeNB has become an important member of the euro system, moving from issuing shillings to supporting euro circulation.

organizational structure<

ul style="list-style-type: disc" type="disc">governance: led by the president, who represents Austria on the European Central Bank (ECB) Governing Council. The General Council and Executive Committee assist in strategic and operational decision-making.

key sectors, including monetary policy, financial stability, statistics, payment systems, and research, which work with the ECB to ensure alignment with the goals of the eurosystem.

staff team: Approximately 1,100 employees (based on recent estimates), including economists, analysts, and financial experts, with a focus on research and policy innovation.

Regulation & ComplianceAustria

: Governed by the Austrian National Banking Act and as a member of the Eurosystem, following the regulatory guidance of the European Central Bank (ECB).

international standards: As part of the Eurosystem, OeNB adheres to international regulatory standards such as Basel III to ensure financial stability.

Recent Compliance Record:

- As

a central bank, OeNB focuses on supervising and stabilizing the financial system, with no publicly documented significant compliance issues.

Its activities are regularly reviewed by the ECB and the Austrian government, which can be found in the annual report (OeNB Annual Report).

products and services

for individuals:

offers high-quality, anti-counterfeit cash in euros (banknotes and coins).

Publish economic analysis, statistics, and reports for use by the public and researchers.

The Statistik App is available for easy access to economic data on mobile devices.

For corporates:

support corporate financing conditions through monetary policy, such as liquidity management and interest rate policies.

Supervise payment systems to ensure secure and efficient transactions between businesses and banks.

Provide economic analysis and statistics to help business decision-making.

international role

Global Cooperation: Collaborate with institutions such as the International Monetary Fund (IMF), the Bank for International Settlements (BIS), and the World Bank to promote global financial stability and economic research.

regional support: Leveraging Austria's geographical and historical advantages in Central Europe, technical assistance and knowledge sharing for Central and Eastern European countries.

Eurosystem contribution: As a member of the Eurosystem, OeNB is involved in shaping monetary policy affecting the 20 countries of the Eurozone, including setting interest rates and managing liquidity.

research and innovation<

ul style="list-style-type: disc" type="disc">Economic Research: Known for its high-quality economic research, it publishes working papers, research reports, and the quarterly journal Monetary Policy and Economics. Research topics include inflation, financial stability, and digital currencies.

data center: Maintains a comprehensive database of macroeconomic and financial statistics, accessible through the OeNB website and the Statistik App, for researchers, policymakers, and businesses.

payment innovation: actively explore digital payment systems and central bank digital currencies (CBDCs), and participate in ECB discussions on the digital euro.

sustainability initiatives<

ul style="list-style-type: disc" type="disc">Green Finance: Integrate environmental sustainability into operations, support ECB's climate-related financial policies, study the impact of climate risks on financial stability, and promote green bonds.

Sustainable investing: Portfolios are increasingly focused on ESG (Environmental, Social, Governance) criteria, in line with global sustainability goals.

Public awareness: Raising awareness of sustainable finance among businesses and the general public through educational activities.

technological advances<

ul style="list-style-type: disc" type="disc">digital tools: In addition to the Statistik App, OeNB provides an interactive online platform that enables real-time economic data visualization and enhances the user experience.

Cybersecurity: Invest in robust cybersecurity measures to protect sensitive financial data and payment systems, and work with ECB to combat cyber threats.

FinTech: Monitoring and research on fintech developments to ensure the competitiveness and resilience of the Austrian financial system in the digital economy.

community and education outreach<

ul style="list-style-type: disc" type="discFinancial literacy: Promote public understanding of monetary policy, banking, and economic principles through seminars, lectures, and online resources. The Vienna Currency Museum offers interactive exhibits on the history of money and financial education.

Academic collaboration: Collaborate with universities and research institutes to fund scholarships and research projects to promote economic research.

Public Event: Host an annual economic conference that brings together policymakers, academics, and industry leaders to discuss global economic trends.

featured contributions

cultural heritage: Preserve the history of Austrian currency through the Currency Museum and Numismatic Collection, and demonstrate the cultural significance of money.

Gold Reserves: Managing one of the highest levels of gold reserves per capita in the world, ensuring Austrian financial sovereignty and participating in global reserve management discussions.

neutral platform: Drawing on Austria's tradition of neutrality, international financial forums and seminars are held to promote global economic dialogue.

the service obtains

online resource: OeNB (https://www.oenb.at) provides reports, datasets, and policy updates in German and English.

public consultation: In addition to the contact form and phone support, OeNB shares monetary policy and economic insights through social media such as X.

Annual Report: Detailed financial and operational information is available in the annual report downloaded from the official website for transparency.

security measures

Security measures: to ensure the high quality and security characteristics of euro banknotes and coins.

Risk Management: Cooperate with international financial institutions to prevent currency counterfeiting and money laundering.

Regular audits: Subject to regular audits by the ECB and the Austrian government to ensure compliance and security.

Data protection: Protects economic data and monetary information using advanced encryption technology.

Featured Services and Differentiation

EuroSystem role: As a member of the Eurosystem, OeNB plays a key role in European monetary policymaking, Representing Austrian interests.

Currency Reserve Management: Managing Austria's gold and foreign exchange reserves to support the stability of the euro in a crisis.

Economic Analysis & Data: Provides comprehensive economic analysis and statistics for academic research, corporate decision-making, and public education.

Financial Education: Promote public understanding of the financial system through reports, publications, and educational programs.

summary

The Austrian National Bank (OeNB) is Austria's central bank that focuses on monetary policy, financial stability, and economic analysis, and does not provide traditional banking services. As part of the Eurosystem, it is regulated by the ECB and the Austrian National Banking Act, and its financial position is supported by the state to ensure soundness. Digital services such as the Statistik App provide economic data to the public and researchers, and security measures and educational programs are featured. Customers can check regulatory information through the FMA or OeNB official website, which is suitable for users who are interested in monetary policy and economic analysis.