basic bank information

RAKBANK (RAS AL KHAIMAH NATIONAL BANK) IS THE UAE'S LEADING COMMERCIAL BANK AND A REGIONAL PRIVATE BANK SERVING RETAIL AND CORPORATE CUSTOMERS.

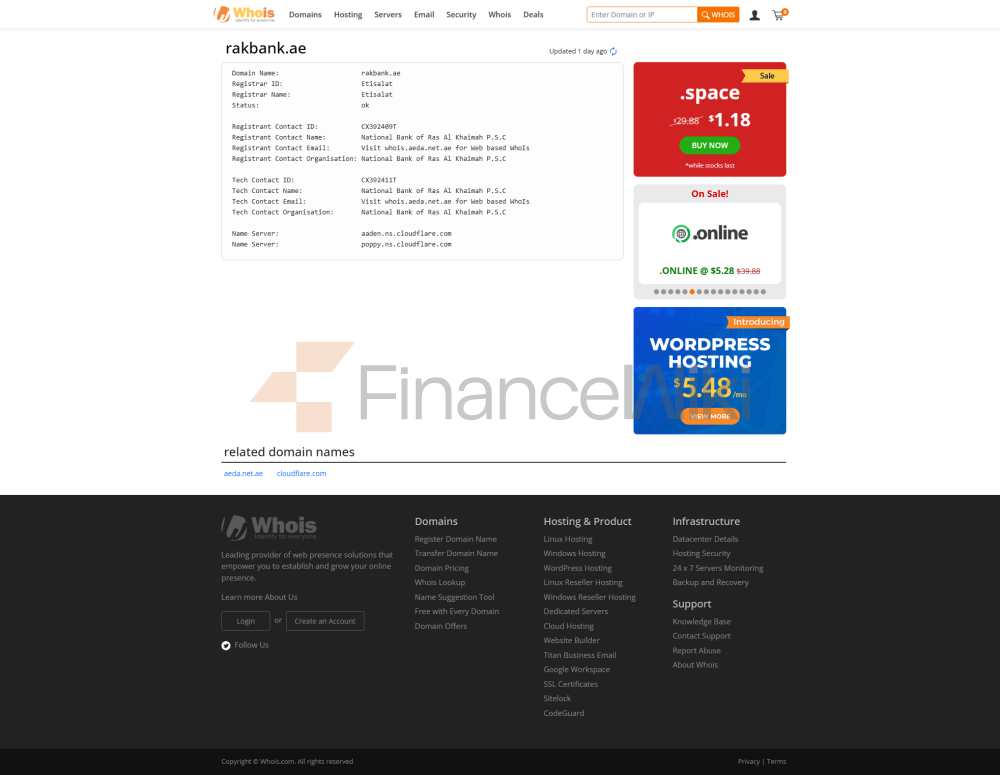

name and background: The full name is RAKBANK (National Bank of Ras Al Khaimah), which was established in 1976 and is headquartered in Ras Al Khaimah, United Arab Emirates. The bank is listed on the Emirates Stock Exchange (ticker symbol: RAKBANK) and its major shareholders include UAE government-related entities and institutional investors.

service scope: The business covers the whole of the UAE, focusing on serving local and cross-border customers, especially in the small and medium-sized enterprise (SME) and retail banking sectors. There are a large number of offline outlets, and the ATM network is located in major cities in the UAE, supporting a wide range of cash deposits and withdrawals and payment services.

Regulation & Compliance: Regulated by the Central Bank of the United Arab Emirates (CBUAE) and strictly adhering to Islamic finance regulations (providing Sharia-compliant banking products). It is a member of the UAE Deposit Insurance Scheme, with a maximum protection limit of AED 200,000 (about US$54,000) per depositor37.

financial health

:

- >

non-performing loan ratio: Remain at a low level (about 3%-4%), reflecting its prudent risk management strategy.

Liquidity Coverage Ratio: Above regulatory requirements to ensure short-term solvency.

capital adequacy ratio: Robust, Basel III compliant, with core capital adequacy ratios above 15% in 2024.

deposit and loan products

Deposits:

- >

competitive time deposit interest rate, 1-year interest rate of about 3.5%-4.5%;

featured products include the "RAKFlex" savings account (flexible deposits, tiered interest rates) and CDs with a minimum deposit of AED 100,000 and an interest rate of up to 5%.

demand deposits have a lower interest rate but provide high liquidity;

Loan class:

mortgage: interest rate fluctuating (EIBOR+2.5%-4%), minimum down payment of 20%;

car loan: 6%-9% annualized interest rate, pre-approval in 1 hour at the earliest;

personal line of credit: 8%-15% annual interest rate for unsecured loans, fluctuating according to the customer's credit score;

offers flexible repayment options, such as interest-only payments for the first 6 months, extended loan tenure, etc.

list of common fees

account management fee: No monthly fee for the basic account (minimum balance of AED 5,000 is required);

transfer fee: free for domestic transfers, as low as 0.1% for cross-border remittances (e.g. via RippleNet8;

ATM inter-bank withdrawal fee: free at local ATMs, AED 15 per international withdrawal;

Hidden Fee Reminder: Some high-yield accounts need to maintain a minimum balance of AED 100,000, otherwise a monthly fee of AED 50 will be charged.

digital service experience

APP & Online Banking:

- >

integrated investment tools (such as gold, fund trading), and the open banking API supports third-party application access5.

user rating 4.2/5 (Google Play), support face recognition login, real-time transfer, automatic classification of bills;

technological innovation:

- >

robo-advisory services (minimum investment of AED 10,000);

participated in the mBridge project to achieve real-time cross-border settlement between digital dirhams and renminbi (eCNY9.

AI customer service "RAKBOT" handles 80% of common queries;

customer service quality

- >

complaint handling: the complaint rate is lower than the industry average, and 90% of cases are resolved within 48 hours;

Multi-language support: English, Arabic, Hindi, Urdu services are available, suitable for foreign customers.

service channel: 24/ 7. Telephone support, online chat (average response time< 2 minutes), Twitter/X quick response;

security measures

the safety of funds: Deposit insurance coverage + real-time anti-fraud system (interception of suspicious transactions);

Data security: ISO 27001 certified, no public data breaches since 2020.

featured services and differentiation

- >

Green Finance: Launched ESG bonds to raise $600 million to support sustainable projects1;

high-net-worth services: $1,000,000,000 private banking threshold, customized Islamic wealth management solutions.

SME finance : Dedicated "Business Banking" team to provide fast loans (48 hours approval);

market position and accolades

industry rankings: Top 10 banks in the UAE by SME loan market share;

awards: "Best Digital Bank in the UAE" (Global Finance) 2024, "Best SME Bank" (MEA Finance) 2023.