The

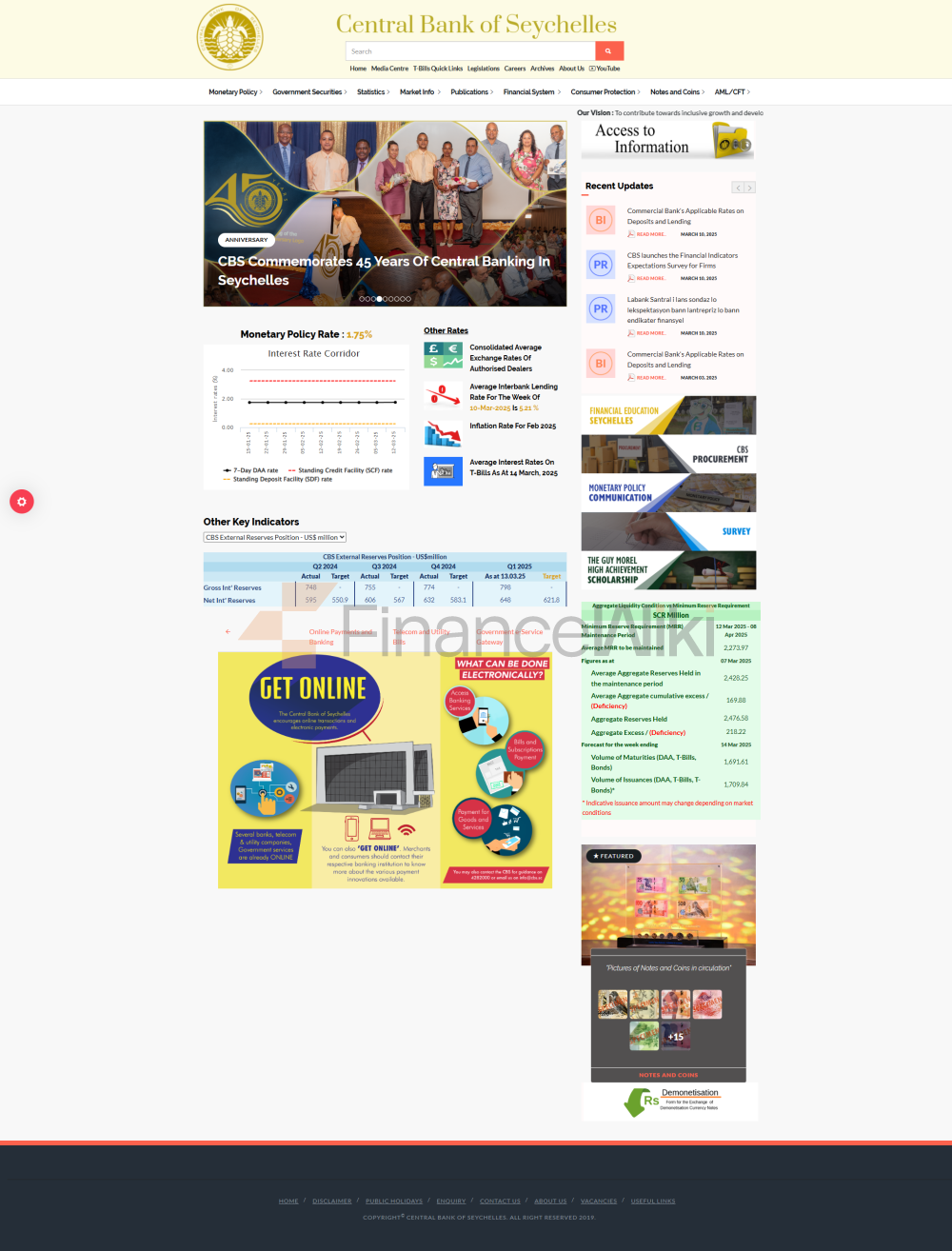

Central Bank of Seychelles (CBS) is the highest financial regulator in Seychelles, established in 1978 and headquartered in the capital Victoria. As the central bank of the country, CBS is a state-owned institution whose main functions include currency issuance, foreign exchange reserve management, maintenance of financial system stability, and macroeconomic policy formulation. Its shareholder background is wholly owned by the Seychelles government and is not listed. CBS does not provide retail banking services directly to the public, but indirectly influences financial markets by regulating the commercial banking system.

Scope of

ServicesCBS's business covers the whole of Seychelles, but as a central bank, its core responsibility is monetary policy regulation and financial supervision, rather than the retail business of traditional commercial banks. As such, it does not have offline outlets or ATM networks, but indirectly affects access to financial services by regulating commercial banks such as the Seychelles Development Bank, the Commercial Bank of Mauritius, etc.

Regulation &

ComplianceCBS is itself bound by the Seychelles legal framework and is responsible for overseeing the domestic commercial banking system. Financial regulators in Seychelles also include the Financial Services Authority (FSA), which is responsible for the regulation of non-bank financial institutions. CBS does not publicly disclose whether it participates in the deposit insurance program, but as a central bank, its policies usually include financial stability measures to safeguard deposits. Recent compliance records show that CBS actively participates in the International Monetary Fund's (IMF) macroeconomic assessments to maintain the soundness of the financial system.

Financial healthAs

a central bank, CBS's core financial indicators are different from those of commercial banks, but key data include:

foreign exchange reserve level: which directly affects the exchange rate stability of the Seychelles rupee 7。

capital adequacy ratio: mainly focuses on its regulatory requirements for commercial banks, rather than its own capital structure.

non-performing loan ratio: The overall risk of the banking sector in Seychelles was controllable in 2020 as indirectly reflected by the data of the commercial banking system.

deposit and loan products

CBS does not directly provide retail deposit or loan products, but influences the deposit and loan interest rates of commercial banks through monetary policy tools (such as reserve requirement ratio, rediscount rate). Commercial banks provide demand/time deposits, housing loans, car loans and other products under CBS supervision, and the specific interest rate is determined by the market.

List of Common Fees

CBS does not cover personal account management fees or transfer fees, but commercial banks' fees are affected by their policies. For example, Seychelles commercial banks may charge cross-border transfer fees or ATM interbank withdrawal fees, which vary from bank to bank.

Digital Service

ExperienceCBS drives the development of fintech, but does not provide retail digital banking services itself. Commercial banks, such as Commercial Bank of Mauritius, provide APP and online banking services to support real-time transfer and bill management, and some institutions may introduce AI customer service or robo-advisors.

Customer Service

QualityCBS's customer service is primarily geared towards financial institutions and government agencies, rather than individual users. Commercial banks' customer service channels (e.g., phone support, live chat) are operated independently by each bank, and CBS is responsible for overseeing their compliance.

Security

MeasuresCBS maintains the stability of the financial system through monetary policy, but the safety of personal funds is mainly guaranteed by deposit insurance (if any) and anti-fraud technology of commercial banks. In terms of data security, CBS follows international standards, but does not disclose whether it is ISO 27001 certified.

Featured Services & DifferentiationCBS

is centred on macroeconomic management, such as maintaining the stability of the rupee exchange rate and supporting key sectors such as tourism and fisheries. Commercial banks may offer student accounts or green financial products, but CBS does not directly participate in the retail market.