Bank Basics:

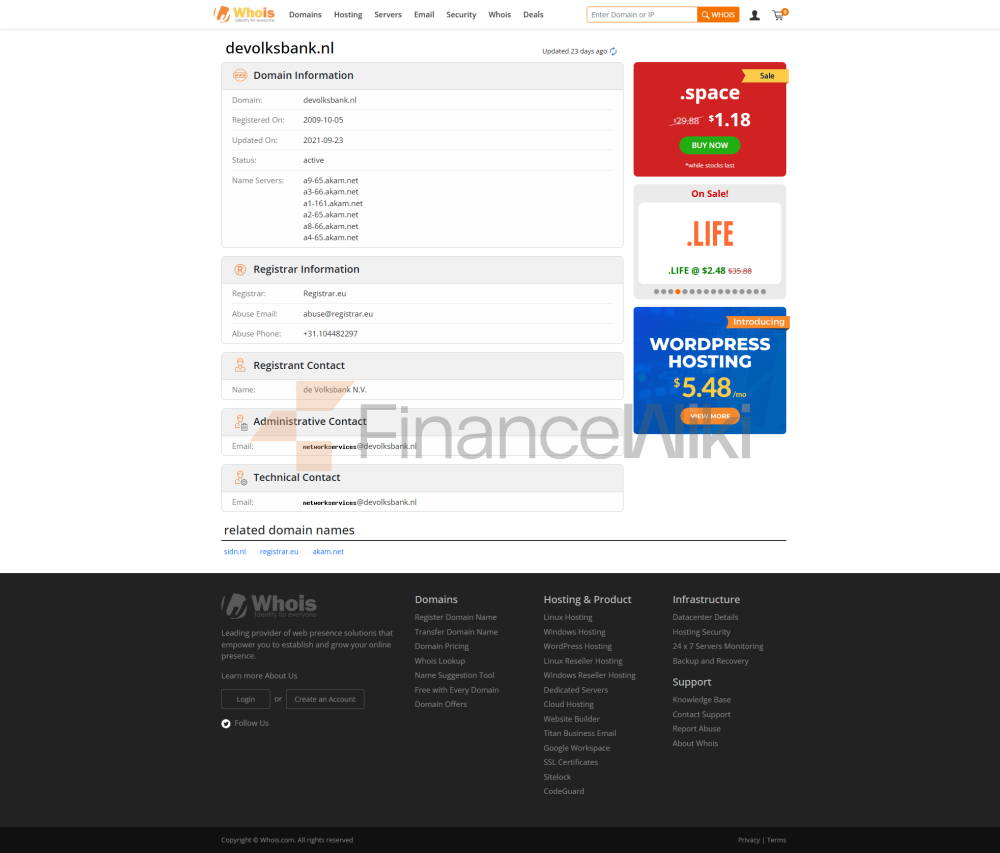

De Volksbank NV is a Dutch state-owned commercial bank that combines the rigor of a business entity with the stability of government support with a focus on serving Dutch retail customers. Wholly owned by the Dutch government through NLFI, a foundation that manages the country's financial interests, the bank is a commercial bank focused on retail banking, mortgage and savings. It is neither a joint venture nor a public company, which ensures that its priorities are in line with national interests and customer needs, rather than shareholder pressure.

Name & Background

- Full

name: De Volksbank NV

Founded: Founded in 2017, it inherits the tradition of SNS banking, and its roots can be traced back to Dutch savings bank in 1817.

Headquarters location: Croeselaan 1, 3521 BJ Utrecht, The Netherlands—a vibrant hub in the heart of Utrecht

Shareholder Background: The company is 100% nationalized through the NLFI and was nationalized during the 2013 financial crisis. The company is neither publicly traded nor privately owned, which gives it the unique advantage of prioritizing long-term customer value over short-term profits.

Services:

De Volksbank is a retail banking business in the Netherlands under brands such as SNS, ASN Bank, RegioBank and BLG Wonen. The bank is not a global bank, but its regional presence ensures strong market penetration. The bank has about 200 brick-and-mortar branches, mainly SNS and RegioBank outlets, with a focus on community service, especially in small towns. ATMs are widely available through the Geldmaat network (shared with other Dutch banks), with more than 7,000 ATMs nationwide, ensuring convenient cash deposits and withdrawals. Online banking and mobile banking complement its brick-and-mortar business, giving it a nationwide reach.

Regulation & Compliance:

De Volksbank is subject to strict prudential regulation by the Dutch Central Bank (DNB), Market Conduct Regulation by the Dutch Financial Market Authority (AFM), and by the European Central Bank (ECB) under the European Union's Single Supervisory Regime (SIPO). It is a member of the Dutch Deposit Protection Scheme (DGS) and provides deposit protection of up to €100,000 per customer, forming a reassuring safety net. It has a strong recent compliance record, with no major fines or scandals in the past five years, demonstrating its commitment to transparency and regulatory compliance.

Financial health:

Capital adequacy ratio (CET1 Ratio) : Around 20% (well above the regulatory minimum of 10.5%), signaling robust capital buffers.

Non-performing loan ratio: about 1.5%, which is low by industry standards, indicating cautious lending practices.

Liquidity Coverage Ratio (LCR): Over 150%, well above the 100% requirement, ensuring that it is resilient to liquidity shocks.

These indicators indicate that a bank is financially sound and a safe bet for both depositors and borrowers.

Deposit & Loan Products

Deposits: Interest-free current accounts and savings accounts with competitive interest rates (e.g., flexible savings rates of 1.5-2% and higher fixed deposit rates). ASN Bank, a brand of Deutsche Deutsche Bank, offers sustainable savings accounts linked to green investments. Term deposits (similar to certificates of deposit) have maturities of 1 to 10 years and long-term interest rates of up to 2.5%.

Loan Category: Focus on providing mortgages through BLG Wonen and SNS (fixed interest rate minimum 3.5% with a term of 10 years, depending on the loan-to-value ratio). In addition, personal loans (5-7% p.a.) and car loans are available on clear terms. Flexible repayment options, such as partial mortgage prepayment with no penalty, also add to the attractiveness of the loan.

Threshold: Mortgage approval requires a stable income with a debt-to-income ratio of less than 40%. Existing customers only need to go through a minimum credit check to get a personal loan.

List of common fees

account management fee: most SNS and RegioBank current accounts are free if you maintain a minimum balance (e.g. €500); Otherwise, a small monthly fee (€2 to €5) may apply.

Transfer fee: SEPA transfers within the EU via Internet/Mobile Banking are free of charge. Cross-border transfers within the EU range from €0.20 to €5, depending on the urgency.

Overdraft fees: Overdraft rates hover around 10-12% APR, which is reasonable for the Netherlands.

ATM Interbank Withdrawal Fee: Free at Geldmaat ATMs; non-network ATMs may charge €1–€2.

Hidden Fee Tip: Be aware of penalties if your premium account balance falls below the minimum. Be sure to check the terms of your fixed deposit to avoid fees for early withdrawals.

Digital service experience

APP & Online Banking: Deutsche Deutsche Bank's mobile apps (SNS, ASN Bank, RegioBank) are available on the App Store andWith ratings of 4.5/5 and 4.3/5 on Google Play, it has been praised for its user-friendliness. Core features include real-time transfers, bill payments, savings goal tracking, and a mortgage calculator. ASN Bank's app integrates sustainability impact tracking for green accounts.

Technological innovation: Offers AI-powered budgeting tools and facial recognition login. While not leading the way in open banking APIs, it supports PSD2-compliant third-party payment service integrations. There are no smart investment tools yet, but basic online wealth management services are available.

The digital experience is intuitive, but slightly inferior to fintech companies in terms of cutting-edge features.

Customer Service Quality

Service channel: Round-the-clock telephone support (+31 30 291 4200) Responsive with an average wait time of less than 5 minutes. Live chat is available during business hours, and social media (X, WhatsApp) replies are also very prompt, usually within an hour.

Complaint Handling: Low complaint rate (less than 1% of customers per year) and usually resolved within 10 working days. According to an internal survey, customer satisfaction is around 85%.

Multilingual support: Mainly Dutch, with English support available for expats via phone and online. Non-European language options are limited, which can be challenging for some international customers.

Security measures

security of funds: The Dutch General Services Agency (DGS) covers up to €100,000. Real-time fraud detection monitors transactions and flags anomalies instantly. Two-factor authentication (2FA) is mandatory for online banking.

Data Security: ISO 27001 information security certification. There hasn't been a data breach in the past decade, which is a remarkable achievement in an era of increasing cyber threats. Conduct regular security audits to ensure compliance with the General Data Protection Regulation (GDPR) and Dutch data protection law.

Featured Services & Differentiation

market segments:

Student Accounts (SNS) provide free banking and budgeting tools for young people.

Sustainable banking through ASN Bank, whose accounts and investments are linked to ESG principles (e.g. renewable energy, fair trade).

RegioBank provides a personalized, community-focused service to rural customers.

High-net-worth services: There is no dedicated private banking, but quality mortgage and savings products are offered to meet the needs of affluent clients. Clients can get customized financial advice through SNS and BLG Wonen.

Deutsche Deutsche Bank's focus on sustainability and local engagement sets it apart in a highly competitive market.

Market position and accolades

industry ranking: Not in the global Top 50 but ranks among the top 10 Dutch banks by assets (€60–70 billion).

Awards: ASN Bank has been awarded the "Most Sustainable Bank in the Netherlands" (Sustainable Finance Awards 2023) for its focus on Environmental, Social and Governance (ESG). De Volksbank itself was awarded the "Best Customer-Centric Bank" award by the Dutch Banking Association in 2022.