SID Bank (SID – Slovenska izvozna in razvojna banka, d.d., Ljubljana) is a central pillar of Slovenia's economic development and has contributed to the sustainable development and international competitiveness of the Slovenian economy by providing financing and insurance services to businesses and the public sector since its establishment in 1992. As Slovenia's 100% state-owned bank for development and exports, SID Bank is a benchmark for the Slovenian financial system with its focused financial solutions, digital innovation and commitment to the EU's Sustainable Development Goals. This article will provide a comprehensive analysis of the characteristics and advantages of SID banks in terms of institutional profile, financial health, products and services, fee structure, digital experience, customer service quality, security measures, special services and market position, etc., and provide in-depth insights for potential customers and researchers.

Institutional Overview and

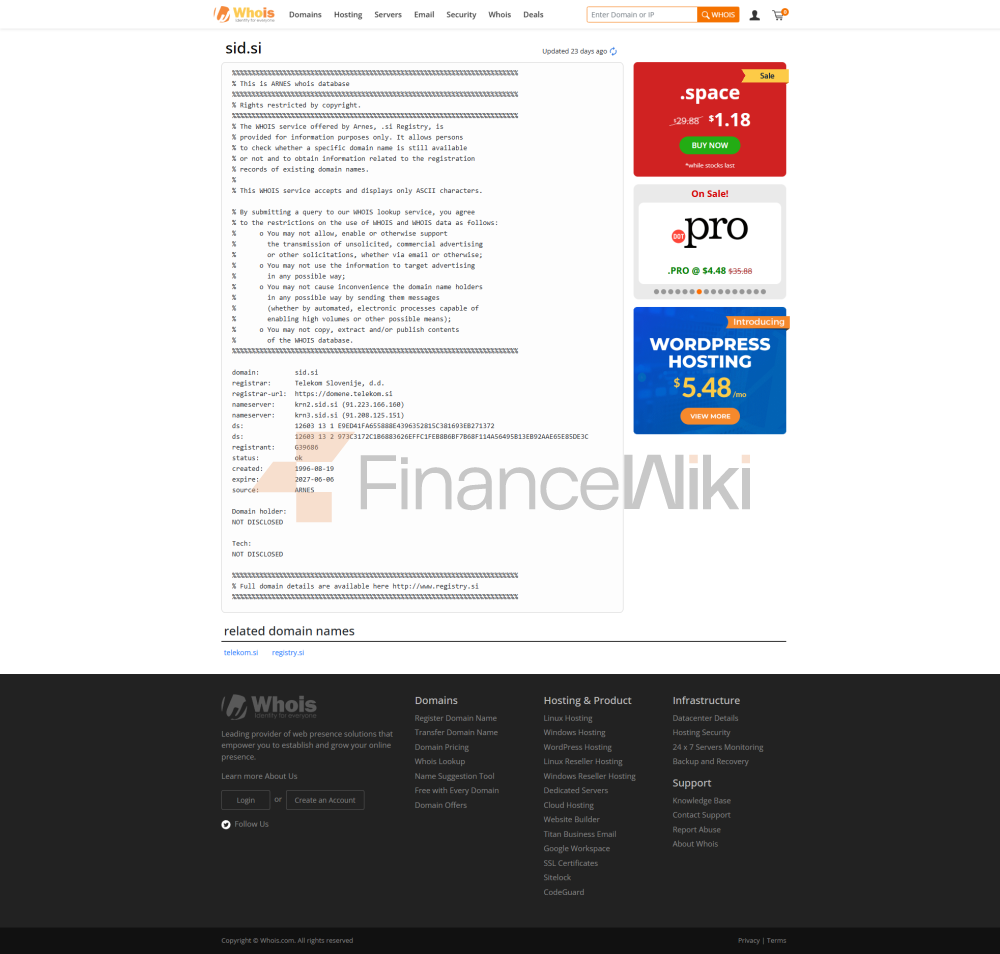

BackgroundSID Bank was founded on 27 October 1992 as Slovenska izvozna družba, d.d., Ljubljana and is headquartered at Ulica Josipine Turnograjske 6, Ljubljana, Slovenia. At the end of 2006, the Bank was licensed by the Bank of Slovenia to transform into a specialized bank for development and exports, and on 28 July 2008, the General Meeting of Shareholders passed a resolution to transfer minority shares to the main shareholder, the Republic of Slovenia, making it a 100% state-owned institution. The SID Bank, which is not listed on the stock exchange and is fully owned by the government, is committed to supporting the export and sustainable development of Slovenian businesses through financing and insurance services.

SID Bank's services cover the whole of Slovenia and support international business through export financing and insurance, especially in the EU and other international markets. Instead of operating a network of traditional retail outlets or ATMs, banks offer their services through a single office location and online platform, ensuring efficient financing and advisory support. SID Bank is the parent company of the SID Banking Group, which includes the Centre for International Cooperation and Development, which provides strategic support to Slovenian companies in their international market entry strategies. Banks are regulated by the Bank of Slovenia and are subject to the Banking Act and EU financial regulations. Due to its primary service to businesses and the public sector, the Deposit Insurance Scheme has limited applicability, but it has a good compliance record with no major breaches reported.

Historical BackgroundThe

establishment of SID Bank was an important milestone in the transformation of the Slovenian economy to market. In 1992, it was established as a Slovenian export company with the aim of providing export insurance and financing support to Slovenian companies. In 2006, the Bank transformed into a Development and Export Bank, expanding its services to include SME financing, green projects and innovation support. In 2019, SID Bank further strengthened its role in the regional economy by investing in the first technology innovation funds in Slovenia and Croatia in cooperation with the European Investment Fund (EIF) and the Croatian Development Bank (HBOR). In 2024, the bank won the Arab Digital Government Award for its digital innovation, highlighting its leadership in the fintech sector.

Financial HealthSID

Bank has a solid financial position with total assets of approximately EUR 2,799.7 million, net income of approximately EUR 8,251,000, share capital of EUR 484.7 million and an audited book value per share of EUR 156.18 in 2022. In 2023, banks continue to maintain a stable income structure to support their operations and growth activities. Specific financial indicators such as capital adequacy ratio, non-performing loan ratio and liquidity coverage ratio are not disclosed, but as a state-owned institution, SID Bank's financial stability is implicitly supported by the government to ensure that it is able to cope with potential risks. Customers can obtain the latest financial data through the annual report on the bank's official website.

Deposits & Financing

ProductsDeposit

ProductsSID Bank does not offer traditional retail deposit products such as demand deposits, time deposits or high-yield savings accounts, and its business model is focused on providing financing and insurance services to corporates and the public sector.

Financing

productsSID Bank offers a wide range of financing products to support the sustainable development of the Slovenian economy, all in line with EU and national development policies:

- SID ZELEN Green Financing Program: supports green projects, financing investments and working capital in Slovenia, up to 10% of the loan value for project preparation and implementation activities. The loan has a lower interest rate and is guaranteed by the European Investment Fund.

- Export financing: Medium and long-term loans for Slovenian companies in international trade, reducing non-market risks and enhancing international competitiveness.

- SME Loans: Supporting SMEs through direct and indirect financing, filling market financing gaps and promoting entrepreneurship and economic growth.

- Innovation and R&D financing: Supporting technological innovation and R&D projects, in line with EU innovation policy.

Flexible Repayment

OptionsSID Bank supports flexible repayment arrangements, allowing repayment plans to be adjusted according to project progress and cash flow, reducing financial stress on businesses.

List of common fees

: SID Bank's fee structure is not disclosed in detail in public sources. As a pro-development bank, its main objective is to provide concessional financing, not to generate revenue through fees. Businesses may be subject to administrative or processing fees when applying for financing, but these are usually specified during the application process. Customers should contact the bank by phone (+386 1 200 75 00) or email ([info@sid.si](mailto:info@sid.si)) for detailed fee information.

Digital Service

ExperienceSID Bank is committed to digital transformation, supporting companies to submit financing applications, track project progress, and obtain consulting services through an online platform. Core features include:

- Account Management: Corporate clients can view financing status and project details online.

- Real-time transfers: support project-related fund transfers (SWIFT code: SIDRSI22).

- Bill Management: Manage payments related to financing.

- Investment tool integration: Provides project investment tracking capabilities.

Since SID Bank's digital services are primarily geared towards corporate customers, user ratings are not available on the App Store or Google Play. User feedback shows that the online platform has improved the efficiency of the application, but the specific experience needs further consultation. Technological innovations include industry-standard encryption and multi-factor authentication (MFA), and in 2024, SID Bank won the Arab Digital Government Award for its digital innovation, highlighting its leadership in technology adoption. There is no explicit mention of AI customer service or open banking API support, but its digital platform is at the forefront of Slovenia's financial sector.

Customer Service Quality

SID Bank's customer service is mainly aimed at the corporate and public sectors and is available through the following channels:

- Telephone support: support via +386 1 200 75 00, Monday to Friday from 8:00 to 16:30 (CET).

- Email: Customers can submit inquiries at [info@sid.si] (mailto:info@sid.si).

- Online platform: The official website provides a contact form to allow customers to submit questions or feedback.

- Social Media: Interact via LinkedIn, and the response speed is not disclosed.

Complaint

HandlingSID Bank has a standardized complaint handling process, and customers can submit feedback through its official website. Specific complaint rates, average resolution times, or satisfaction data are not disclosed, but the process complies with Slovenian banking regulatory requirements.

Multilingual support

is mainly available in Slovenian and English, with other languages available depending on the customer's needs, and cross-border customers need to consult directly.

Security MeasuresSafety

of FundsSince

SID Bank does not accept deposits from the public, its financing activities are protected by the supervision of the Bank of Slovenia and strict risk management. Anti-fraud technologies such as real-time transaction monitoring are used to ensure the safety of funds.

Data

SecuritySID Bank's digital platform uses industry-standard encryption and multi-factor authentication (MFA). No major data breaches were reported, and their state-owned background ensured high security standards.

Featured Services & DifferentiationSID

Bank demonstrates its unique value through the following features:

- Green Finance: The SID ZELEN program supports renewable energy and energy efficiency projects, in line with the EU's Sustainable Development Goals.

- SME support: Fill market gaps through direct and indirect financing to promote entrepreneurship and economic growth.

- Consulting services: provide expert guidance on project planning and implementation for enterprises.

- International cooperation: Helping Slovenian companies to enter international markets through the Center for International Cooperation and Development.

- Community Involvement: Demonstrate social responsibility by supporting education, training, and environmental projects.

Market Position & AccoladesSID

Bank is a leader in the field of financing for development in Slovenia, with total assets of approximately €2.8 billion in 2022, ranking sixth in the country. In 2024, the bank won the Arab Digital Government Award for its digital innovation and supports regional technological innovation through its partnership with the European Investment Fund and the Croatian Development Bank. SID Bank's central role in the sustainable development of the Slovenian economy makes it a key enabler of the country's economic development.

Looking ahead

, SID Bank will continue to drive digital transformation and plan to solve the challenge of 30% of Slovenia's population being unbanked through fintech. In 2025, the Bank will further expand its range of services to support emerging industries and sustainable development projects, consolidating its leadership position in the Slovenian financial sector.