basic bank information

Bank of Tanzania is the central bank of Tanzania, which is fully owned and managed by the Tanzanian government and is responsible for formulating and implementing the country's monetary policy, issuing currency, and maintaining the stability of the financial system. It is not for profit, but for the purpose of serving the country's economic and financial stability as its primary responsibility.

name and background<

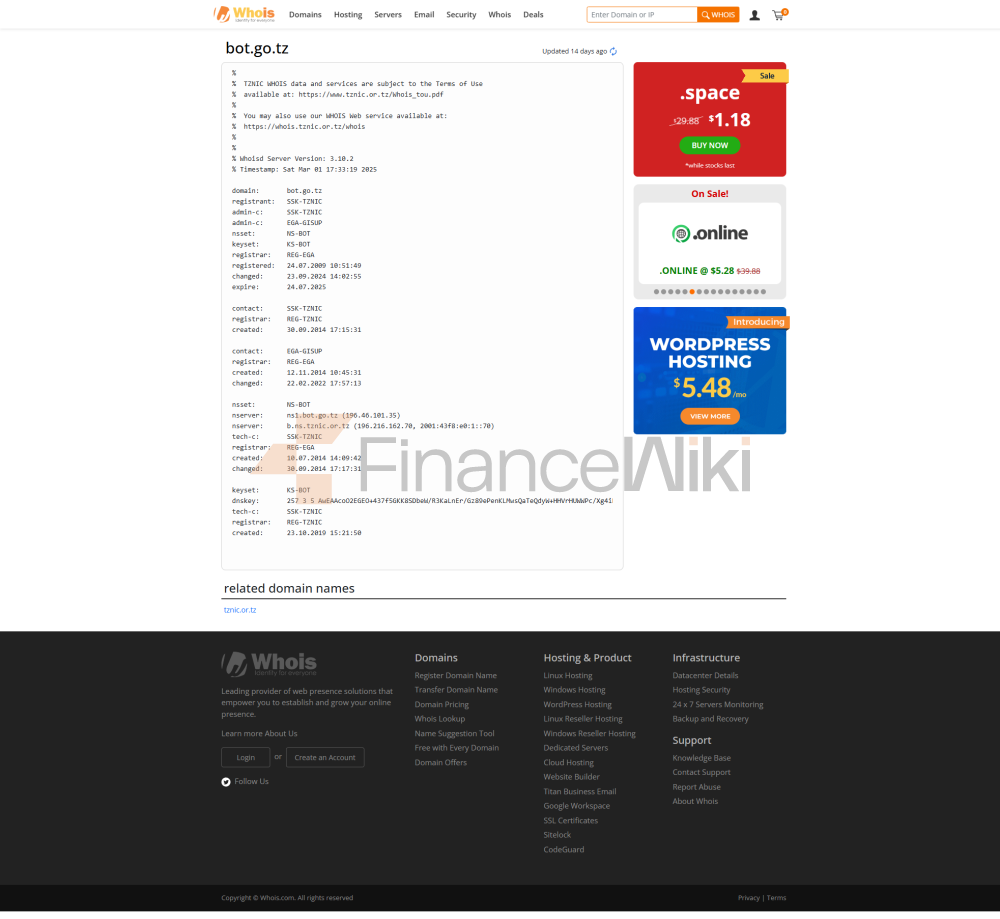

ul style="list-style-type: disc" type="disc">full name of the bank: Bank of Tanzania

founded: 1965

headquarters location: Dar es Salaam

< span style="font-family: sans-serif; color: black" > Shareholder Background: Bank of Tanzania is the central bank of Tanzania, which is fully owned by the Tanzanian government and is not a public or private institution. As part of the government, its core mission is to manage the country's financial policy, issue money, and regulate financial markets.

service scope

Coverage of Bank of Tanzania covers the entire territory of Tanzania. As a central bank, it does not provide financial services directly to individuals or businesses, but rather influences the financial system of the entire country through policy formulation and financial regulation. Its influence is mainly concentrated in Tanzania and does not have a global or regional service network.

Number of offline outlets: Bank of Tanzania has 6 branches in Dar es Salaam (headquarters), Arusha, Mbeya, Mwanza, Zanzibar and Mtwara. These outlets are primarily used to carry out financial regulatory and policy tasks, rather than to provide retail banking services.

services and products

Financial Regulation: Supervise Tanzania's banks, financial institutions, currency exchange offices and social security funds to ensure compliance and stability of the financial system.

currency issuance: responsible for the issuance and management of Tanzania's fiat currency, the Tanzanian shilling.

Government Bank: Acts as the banking and treasury agent for the Government of Tanzania, handling the government's account management and financial affairs.

Financial inclusion: Policies that promote access to financial services and increase financial access for rural and low-income groups.

> Monetary Policy: Formulating and implementing monetary policy to maintain price stability and support economic growth by regulating the money supply and interest rates.

these services are aimed at the entire financial system and the national economy, rather than at the micro level for individual or business customers. Through its policy and regulatory role, the Bank of Tanzania indirectly affects every individual and organization that uses Tanzanian shillings.

security measures<

span style="font-family: sans-serif; color: black"> Bank of Tanzania, as the central bank, has a high standard of security measures in place to protect the financial system and the country's economy, including:

Cybersecurity: Protect against hacking and data breaches, and protect the core information of the financial system.

Data encryption: Ensure secure transmission of policy documents and regulatory data.

despite the technical details not disclosed, its security measures are undoubtedly in line with international standards to combat increasingly sophisticated cyber threats and safeguard financial stability.

Featured Services & Differentiation

Bank of Tanzania is unique in its role and responsibilities as a central bank, the following are its featured services:

Financial Inclusion Policy: Bank of Tanzania is a member of the Alliance for Financial Inclusion, which works to improve access to financial services. In 2016, it launched the National Financial Inclusion Framework (NFIF), which aims to reduce household economic vulnerability due to financial exclusion.

Monetary policy execution: Flexible management of inflation and economic growth through tools such as interest rate adjustments and open market operations.

Financial regulatory innovation: Continuously update the regulatory framework to adapt to changes in the financial market, such as strengthening the supervision of digital financial services.

Bank of Tanzania's differentiating advantage over other banks lies in its macro-management function and its far-reaching impact on the country's financial system. It is not only an issuer of money, but also an enabler of financial inclusion and economic stability.

summary

Bank of Tanzania is the central bank of Tanzania, established in 1965 and headquartered in Dar es Salaam. As a state-owned institution, it is wholly owned by the government and is responsible for monetary policy making, financial regulation, currency issuance, and financial inclusion promotion. The service covers the whole of Tanzania and carries out duties through 6 branches. Although it does not directly provide financial services to individuals or businesses, it profoundly affects the entire financial ecosystem through policy and regulation. Bank of Tanzania, with its authority, professionalism and contribution to financial stability, is a solid pillar of Tanzania's economic development.