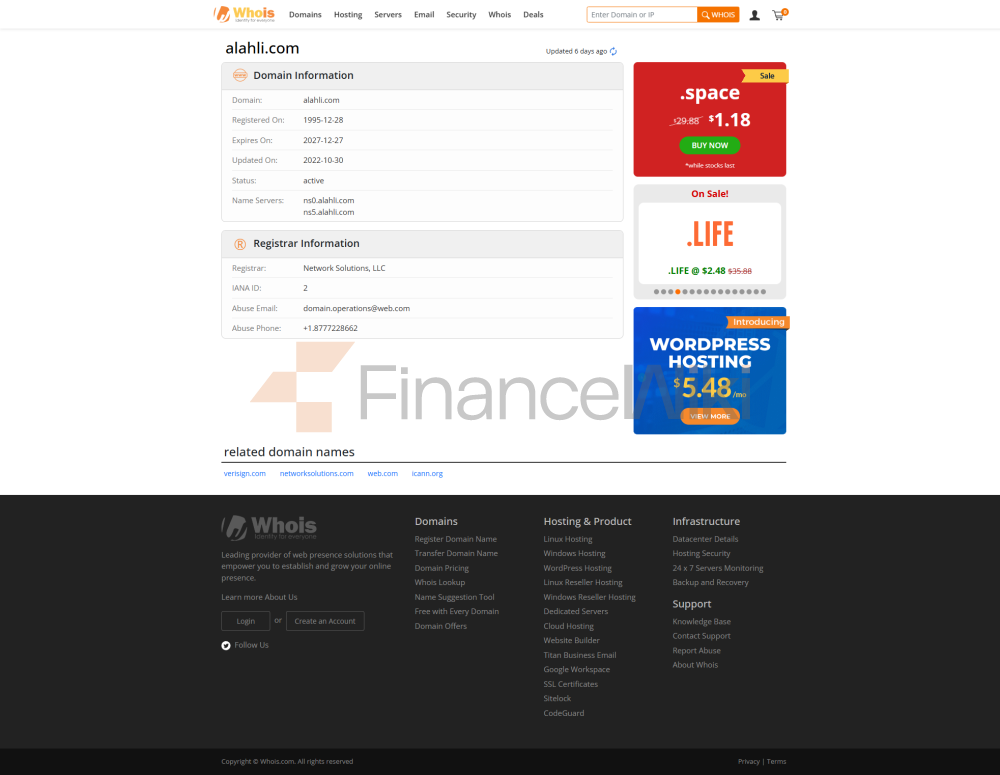

The Saudi National Bank (SNB) was established in 1953 (then the "National Commercial Bank" NCB) and is headquartered in Riyadh, the capital of Saudi Arabia. In 2021, NCB merged with Samba Financial Group (SAMBA) and the new financial entity was renamed SNB (also known as SNB AlAhli). SNB is the first listed joint-stock commercial bank in Saudi Arabia, with the largest shareholder being the Saudi sovereign wealth fund (public investment fund, holding about 37% of the shares), followed by pension institutions, other institutions and the public market. Its nationwide network includes approximately 470 branches, 19 retail service centres and 96 QuickPay remittance centres, as well as four overseas branches in Bahrain, the UAE, Qatar and Singapore. By the end of 2023, SNB had approximately 16,000 employees and a total of approximately 14.2 million customers. SNB is one of the largest commercial banks in Saudi Arabia (with an asset market share of more than 32% among listed banks) with a large network of outlets and ATMs. The bank uses the brand name "AlAhli" externally, and its official website reflects this heritage.

SNBs are regulated by the Saudi Central Bank (formerly SAMA). As a commercial bank, SNB's deposits are protected by the Saudi Deposit Insurance Program (Saudi Depositor's Protection Fund, DPF), which provides compensation of up to SAR 200,000 per account for deposits (principal and accrued profits). In recent years, SNB (formerly NCB) has a good compliance record after the merger, but in 2020, it was fined about $650,000 by the U.S. Treasury Department for sanctions violations in a small number of cross-border transactions (involving Sudan and Syria). No major compliance incidents have been reported since then.

In terms of financial soundness, SNB maintained a high capital adequacy ratio and a low non-performing ratio. In the first quarter of 2024, its Tier 1 capital adequacy ratio was approximately 19% (total capital of approximately 20%), well above regulatory requirements. According to the analysis of professional institutions, SNB's asset quality continued to improve, and by the end of 2024, the Group's non-performing loan ratio was only about 1.2%, and the credit loss coverage ratio was above 200%. In terms of liquidity, SNB holds sufficient high-quality liquid assets, which generally maintain a level above the minimum regulatory requirements. International rating agencies have also given SNB a stable A- rating with a stable outlook, indicating that its asset quality and earnings are performing well. In addition, SNB's total assets in 2023 will be about $276 billion, and its total net profit will be about $5.4 billion, and its profitability will continue to grow driven by oil and gas.

Products &

ServicesSNB offers a wide range of deposit products to meet the needs of individuals and businesses. In terms of current accounts, customers can open electronic current accounts and enjoy the largest ATM network (thousands of ATMs) and 24/7 online banking services in the country. SNB also offers Wessam Banking, a premium account for high net worth clients with a dedicated relationship manager and high credit offers. In addition, SNB has launched a special gold account that allows customers to buy, sell and withdraw physical gold conveniently through mobile or online banking. In terms of fixed deposits, SNB offers fixed-term deposits and large deposits with interest rates fluctuating in accordance with market and regulatory guidance. Overall, SNB account management fees are waived (as long as the average monthly balance requirement is met) and e-banking features are available at free or low rates.

In terms of loan products, SNB covers a variety of options such as personal housing loans, car financing, and personal consumption loans. The home loan (residential financing) is an Ijarah or Murabaha contract and is up to 90% of the value of the financed property (first time buyer) or 70% (in the case of an existing loan). Loan amounts can be up to 7 million riyals with flexible tenors and an annual interest rate (APR) starting from around 6.86%. Customers can also opt for a "2-in-1" plan that combines home loans with personal loans to increase the amount they can borrow. In terms of car financing, SNB provides car rental financing (ijarah), which does not require an income guarantee, is easy to apply, and can choose up to 40% of the final payment (paid in installments) after the purchase of the car. Personal lines of credit (retail credit) are issued primarily through the "Wessam Personal Financing" program, which provides Saudi citizens with pure Muslim-compliant cash loans for tourism, education, renovation and other purposes, without the need for a guarantor, up to several times the borrower's income, and with a maximum repayment period of up to 5 years. Wessam's financing program also includes innovative products such as fast-track personal loan options secured by the purchase of locally listed stocks, commodities or investment funds, which greatly increase liquidity flexibility.

Fee

structureIn terms of fees, most of SNB's banking services are relatively transparent to customers. Account-related fees: Individual account opening and average monthly balance fees are generally waived and there are no annual fees (subsequent administration fees may be charged only under certain conditions). Transfer fees: Intra-bank transfers are usually free of charge (electronic channels), while digital channels for intra-bank intra-bank transfers generally range from SAR 0.5–7 (0.5–1 riyals for small amounts received quickly, and about 5–7 riyals for ordinary next-day transfers). International money transfer costs are approximately 50 riyals for online banking and 75 riyals over the counter. ATM fees: Free of charge for cash withdrawals at SNB ATMs; When using other bank ATMs, there is a fee of about 10 riyals for each cash withdrawal at the domestic market, about 25 riyals for each overseas ATM, and about 5 riyals for balance checking. In addition, foreign exchange transactions will be subject to an exchange rate conversion fee of up to 3% based on the bank's exchange rate. SNB credit card cash withdrawals are high, with a single transaction fee of about 75 riyals, but this falls under the card issuance rate. Generally speaking, unless the policy limit is exceeded, the general banking service charges are clearly disclosed and there are no hidden additional charges.

The Digital Banking Experience

SNB is committed to digital transformation and provides full-featured online and mobile banking services. Its mobile banking app, SNB Mobile, has received good reviews in major app stores: 4.1 stars on Google Play (about 240,000 user reviews) and 4.7 stars on Apple's App Store (47,000 user reviews). Users can view account balances and transaction details, make real-time transfers and payments, pay bills, manage credit cards, purchase wealth management products, etc. through SNB Mobile. Fingerprint and face recognition login are supported, and electronic token (OTP) authentication is provided for security. Online account opening, loan application, precious metal trading and other operations can also be completed in the app. SNB also provides tools such as home financial planning, portfolio management and other intelligent functions in online banking, and continuously improves AI customer service and robo-advisory capabilities (using chatbots, scenario-based recommendations and other technologies). In terms of open banking, SNB has cooperated with regulators and third-party payments, gradually opening API interfaces, and supporting access to third-party financial management tools and payment scenarios, in line with the development of Saudi Arabia's fintech ecosystem.

Customer Service

SNB provides customers with multi-channel service support. The main service channels include: national branches, telephone banking (toll-free numbers in Saudi Arabia 920001000 and complaint hotlines 8001160131), online customer service (built-in chat function on website and mobile banking), email and social media, etc. Bank customer service is usually available in Arabic and English, and there is also bilingual support for special customer groups, such as expatriate employees. According to publicly available information, SNB responds to customer complaints in a timely manner (telephone services are usually accepted immediately during business hours and a written response is provided within a few days). Private banking clients receive a higher level of personalized service. According to official information, SNB won the "Best Customer Loyalty Program" and several "Best Banking Services" awards in 2019, reflecting the industry recognition for its customer service and product satisfaction.

In terms ofsafety and security

of funds, SNB, as a member bank under the supervision of SAMA, has its deposits included in the Deposit Protection Fund operated by the Saudi Central Bank, and customer deposits (principal and accrued earnings) are protected up to SAR 200,000 in the event of bank failure. SNB has established a multi-layered security system in-house, including daily transaction monitoring, an anti-fraud rule engine, and dynamic authorization technology to prevent suspicious transactions. Both online and mobile banking use HTTPS encryption and two-factor authentication, enabling data encryption and intrusion detection systems. In terms of data security certification, SNB has established a sound management system and is moving closer to international information security standards such as ISO/IEC 27001 (currently in the implementation stage). To date, there have been no major customer data breaches at SNB. To enhance security, banks also implement regular security education and anti-money laundering training to ensure compliance with regulatory requirements such as the Financial Intelligence Unit Anti-Money Laundering Regulations. Overall, SNB relies on regulatory compliance and technical measures to provide customers with adequate risk prevention and asset protection.

Featured Services and Differentiated

SNBs launch special services for different customer groups. For example, in terms of student and youth finance, banks provide student accounts and education-related loans (covering study abroad, vocational training, etc.), and set up financial literacy stations on some campuses. Elderly customers can apply for exclusive wealth management products (such as customized annuity plans) and enjoy free handling fees. In the field of green finance, SNB actively responds to the national call for environmental protection, issues green/socially responsible bonds, and integrates sustainable development principles into loan approvals, such as giving preferential financing interest rates to green projects. High Net Worth Private Banking: SNB's Private Banking division provides customized services such as family trusts, cross-border wealth succession and dedicated investment advisors to sophisticated and wealthy clients. With these differentiated products, SNB strengthens its leading position as an integrated financial platform.

Market Position &

HonorSNB is the leading domestic banking industry in Saudi Arabia with its huge asset scale and market share. In the "Top 10 Arab Banks of 2023" selected by The Banker magazine, SNB continues to be the largest bank in the Arab region by Tier 1 capitalization; Forbes Middle East 2024 lists it as the second most valuable bank in the Middle East. Total assets of approximately $276 billion make it one of the top 100 banks in the world. Over the years, SNB has won many industry awards, such as "Best Corporate Bank" (Islamic Business & Finance of the Year) by The Banker (Middle East Edition) of the China Financial Times, and "Best Digital Bank in Saudi Arabia" and "Best Mobile Banking App" by Global Finance. These awards demonstrate SNB's dual strength in the field of traditional banking and digital innovation. To sum up, as a financial giant in Saudi Arabia and even in the Middle East, Saudi National Bank has established a good industry position and brand reputation with a sound regulatory environment, stable financial indicators and diversified service capabilities.