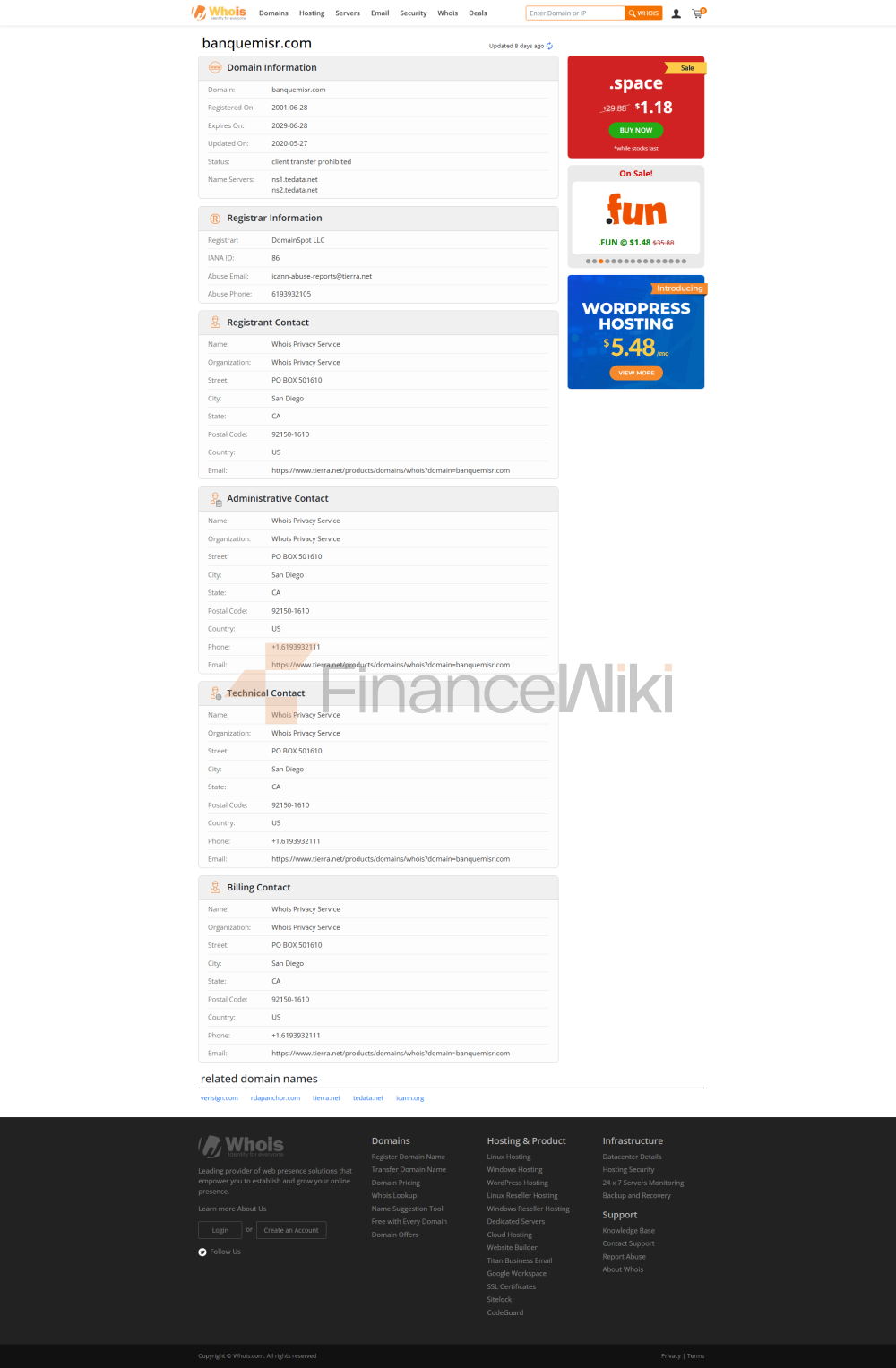

Basic information

Banque Misr is a state-owned commercial bank wholly owned by the Government of Egypt and nationalized by the Government of the United Arab Republic in 1960. As Egypt's second-largest bank, it plays a central role in the country's financial market, functioning as a commercial bank and supporting the country's economic strategy. It has a long history, is rooted in the Egyptian economy, and is committed to financial inclusion and sustainable development.

name and backgroundFull

name: Banque Misr SAE (Arabic: بنك مصر)

was founded in 1920 by Egyptian economist Talaat Harb Pasha and industrialist Joseph Aslan Cattaui Co-founded by Pasha, it is the first bank in Egypt to be entirely Egyptian-owned.

Head office: Cairo, Egypt, 151 Mohamed Farid Street, Down Town, Cairo, Egypt.

Shareholder Background: 100% state-owned, unlisted, fully controlled by the Egyptian government, supporting the national economic strategy through its investments in multiple sectors such as finance, tourism, agriculture, etc.

Coverage: Banque Misr has extensive coverage in Egypt, branches in all provinces, and regional and international presence. The international business includes subsidiaries in the UAE (5 branches), France (1 branch), Lebanon and Germany, as well as representative offices in China, Russia, South Korea and Italy.

Number of offline branches: As of 2023, there are about 800 digitally connected branches, making it one of the largest banking networks in Egypt.

ATM distribution: With 2,516 ATMs covering the whole country, it is the largest ATM network in Egypt, which is convenient for customers to withdraw money and handle business at any time.

Regulation and compliance

is regulated: Primarily regulated by the Central Bank of Egypt (CBE), subject to Law No. 88 of 2003 and Banking Law No. 194 of 2020. In addition, international standards such as the Basel Accord and the Principles for Responsible Banking (PRB) are followed.

Deposit Insurance Program: Egypt currently does not have a clear national deposit insurance program, and Banque Misr's deposits rely on its state-owned background and government support for the safety of its deposits, but there is a lack of specific insurance coverage.

Recent Compliance Record: Banque Misr has partnered with Thomson Reuters to provide customized compliance and anti-money laundering training in compliance with the Central Bank of Egypt. However, in BankTrack's 2021 Human Rights Benchmark Assessment, banks were rated as "laggards" (0.5/14) for their lack of robust human rights policies and complaint mechanisms.

key indicators

of financial health:capital adequacy ratio: approximately 15% as of 2020, Meets Basel III requirements and demonstrates a strong capital buffer.

Non-performing loan ratio: about 3-4% (2022 data), which is lower than the industry average, reflecting good asset quality.

Liquidity Coverage Ratio: Over 100%, indicating sufficient short-term liquidity to cope with market volatility.

Overall Verdict: Banque Misr is financially sound, benefiting from a state-owned background and a broad client base, with strong risk management capabilities, but there is room for improvement in sustainable finance disclosures.

Deposit & Loan

ProductsDeposit class:

- Current

account: provides basic account functions, Interest rates are lower (about 0.5-1%).

Fixed deposits: maturities from 1 month to 7 years, interest rates ranging from 7% to 12% (depending on maturity and amount), recently increased to combat inflation.

High Yield Savings Account: Such as the "Elite Savings Account", the interest rate can be up to 10% per annum, and a minimum balance of EGP 100,000 is required.

Large Certificate of Deposit (CD): 3-5 year certificates are available, with interest rates up to 12.5%, suitable for long-term savers.

Loans:Housing loan: The interest rate is about 8-10%, the term is up to 20 years, proof of stable income is required, and participation in the central bank's housing loan program for low-income groups.

Car loan: interest rate 9-12%, term 1-7 years, support for new and used cars, faster approval.

Personal Line of Credit: Interest rate 10-14%, amount up to EGP 2 million, credit assessment required.

Flexible repayment options: Some loans allow you to make early payments or adjust your repayment plan with no additional fees.

list of common expenses

account management fee: about 10-20 egp per month for current accounts, There is no monthly fee for high-yield accounts, but a minimum balance is maintained.

Transfer fees: Free for domestic transfers or as low as EGP 5, 0.5%-1% for cross-border transfers (minimum EGP 50).

Overdraft fees: Overdraft rates range around 16-20% depending on the account type.

ATM inter-bank withdrawal fee: The Bank's ATM is free of charge, 5-10 Egyptian pounds per inter-bank transaction.

Hidden Fee Alert: Some accounts require a minimum balance (e.g. 5,000 Egyptian pounds), otherwise a fine of 20-50 Egyptian pounds will be charged; Early withdrawal of time deposits may result in a partial loss of interest.

digital service experience

APP and online banking:

- BM

Online and BM The Wallet app supports both individual and business customers, with a score of about 4.2/5 on the App Store and 4.0/5 on Google Play.

Core functions: Supports face recognition login, real-time transfer (including cross-border), bill payment, investment product purchase, and credit card management.

Technological innovation:Introduce AI customer service to provide 24/7 basic query services, but complex problems still require manual intervention.

Robo-advisor: Recommend investment portfolios through the APP, suitable for beginner investors.

Open Banking API: Partnered with NymCard to launch Apple Pay tokenization service in 2024 to support secure payments.

Customer Service Quality

Service Channel:

24/7 phone support: Call center (19888) responds around the clock, covering Egyptian and international customers.

Live chat: The BM Online platform offers live chat with a response time of about 5-10 minutes.

Social Media: Quick replies via Facebook and Twitter, with an average response within 1 hour.

Complaint handling: The complaint rate is medium, the average resolution time is about 3-7 working days, and the user satisfaction rate is about 80%.

Multi-language support: Arabic and English services are available, and some branches support French, which is suitable for cross-border customers, but non-local language service coverage is limited.

security measuresFunds

security:

There is no explicit deposit insurance plan, but the state-owned background provides implicit guarantees, The security of customer deposits is high.

Anti-fraud technology: real-time transaction monitoring, 3D secure payment authentication, and enhanced payment security in partnership with Apple Pay in 2024.

Data Security:PCI DSS 3.2.1 certified, the first bank in Egypt and North Africa to comply with this standard.

There is no disclosure of ISO 27001 certification, and no major data breaches have been reported in recent years.

Featured Services & Differentiated

Segments:

student account: no management fee, Comes with a low-limit credit card, suitable for young people.

Exclusive wealth management for the elderly: provide high-yield time deposits and priority counter services.

Green financial products: Invest in renewable energy projects (such as solar power plants) to support ESG goals, and allocate a total of 5 billion Egyptian pounds for environmental protection projects.

High Net Worth Services:Private Banking: With a threshold of about EGP 5 million, we offer customized investment portfolios and dedicated financial advisors.

Market Position &

HonorIndustry Ranking:

Domestic: Egypt's second largest bank, The asset size is about $170 billion (2023).

Global: The World Benchmarking Alliance's 2022 financial system benchmark ranking is 239/400, first in North Africa, but 115/155 among global banks.

Awards:Global Finance Magazine: Awarded "Best Money Market Fund Provider in the Middle East" several times between 2008 and 2023.

Bloomberg: Best Lead Underwriter in the Egyptian Banking Sector for the third quarter of 2017, ranked 5th in the MENA region.

The first in Egypt and North Africa to achieve PCI DSS certification, demonstrating its technological leadership.