Basic

InformationThe Bank of Uganda is the central bank of Uganda and is a state-owned institution rather than a commercial bank or joint venture bank. It is wholly owned by the government but operates independently of government departments and is responsible for setting monetary policy, managing foreign exchange reserves, and regulating the financial system. The central bank's role makes it a central part of Uganda's economy, with the aim of maintaining financial stability and promoting economic growth.

Full name and background

: Bank of Uganda (Swahili: Benki Kuu ya Uganda)

was established in 1966 by an act of parliament.

Headquarters location: Bank of Uganda Building, Motijheel area, Kampala, Uganda.

Shareholder Background: Fully owned by the Government of Uganda, unlisted, non-private enterprise. As a central bank, its primary objective is the public good, not shareholder profits. Historically, the International Monetary Fund (IMF) supported its recapitalization between 1987 and 1997, enhancing its independence and professionalism.

Coverage area: Bank of Uganda's service scope is mainly concentrated in the whole of Uganda, not directly facing the global market, but indirectly participating in international affairs through foreign exchange reserve management and international financial cooperation (such as the IMF, the African Development Bank).

Number of offline outlets: As a central bank, it does not directly operate retail outlets for the general public, but handles money supply, storage, and clearing through branches and money centers across the country (e.g., Mbale, Gulu, Mbarara, etc.). The exact number of outlets is not disclosed, but it is large enough to cover major cities and towns.

ATM distribution: Bank of Uganda does not directly manage the ATM network, but indirectly influences ATM distribution by regulating commercial banks. As of 2023, there are about 818 ATMs across Uganda, mainly operated by commercial banks, concentrated in urban areas.

Regulatory & Compliance

Regulator: The Bank of Uganda is the highest regulator of Uganda's financial system and directly regulates commercial banks, credit institutions, microfinance institutions and foreign exchange authorities under the Financial Markets Act and the Uganda Banking Act.

Deposit Insurance Scheme: Depositors have been protected since 1997 through the Deposit Protection Fund of up to 10 million Ugandan shillings (approximately US$2,600) per account to protect their interests in the event of bank failures.

Recent compliance record: Bank of Uganda has a solid compliance record, but in 2019 it fired seven directors due to internal management issues (allegedly printing money without permission), which raised concerns. It has since restored public trust through enhanced internal audit and transparency measures. In 2024, Uganda was removed from the greylist by the Financial Action Task Force (FATF), demonstrating a significant improvement in its AML and CFT compliance capabilities.

Key indicators of

financial health:

capital adequacy ratio: As a central bank, Bank of Uganda does not directly publish the capital adequacy ratio of commercial banks, but the average capital adequacy ratio of commercial banks under its supervision is 25.1% (Q2 2024), This is well above the 8% required by Basel III and reflects its stringent regulatory standards.

Non-Performing Loan Ratio: Regulatory data showed that the overall non-performing loan ratio of Uganda's banking sector was 4.9% (Q2 2024), a slight improvement from the previous quarter (5.1%), indicating stable loan quality.

Liquidity Coverage Ratio: The Bank of Uganda requires commercial banks to maintain a minimum of 20% of their deposit liabilities in liquid assets, and the industry as a whole has sufficient liquidity, with a loan-to-deposit ratio of 64.6% (Q2 2024), indicating good liquidity management.

Summary: Bank of Uganda ensures the overall financial health of Uganda's banking sector through strict regulation, which is highly resilient to risks and suitable for investors and depositors who rely on a stable financial environment.

Deposits & Loan

ProductsDeposits: As a central bank, Bank of Uganda does not directly provide retail deposit products, but sets a deposit interest rate policy (such as the benchmark interest rate, which is 9.75% in October 2024), which affects the current and time deposit rates of commercial banks. Commercial banks typically offer demand deposits (interest rates of about 0.5%-2%) and time deposits (1-year interest rates of about 4%-7%), and high-yield savings accounts and certificates of deposit are provided by individual commercial banks (such as Stanbic Bank), and the Bank of Uganda only oversees their compliance.

Loans: Similarly, the Bank of Uganda does not issue loans directly, but influences the lending rates of commercial banks through monetary policy (the average lending rate in 2024 is about 19.1%). Mortgages, car loans, and personal lines of credit are provided by commercial banks, and the thresholds usually include stable income and collateral, and some banks support flexible repayment (such as deferred or early repayment without penalty).

Summary: Deposit and loan products rely on commercial banks, and Bank of Uganda ensures market fairness and stability through policy regulation.

List of Common

Fees Account Management Fees: Bank of Uganda does not charge retail fees directly, but regulates the fees charged by commercial banks. Commercial banks in Uganda usually charge a monthly account management fee (approximately 5,000-20,000 Ugandan shillings, approximately US$1.3-5.2), depending on the type of account.

Transfer fees: Domestic transfers cost about 2,000-10,000 Ugandan shillings ($0.5-2.6), and cross-border transfers are higher (about $20-$50) and are executed by commercial banks.

Overdraft and ATM withdrawal fees: Overdraft fees are about 1.5 times the interest rate on loans, and interbank ATM withdrawal fees are about 5,000-10,000 Ugandan shillings ($1.3-2.6).

Hidden Fee Alert: Some commercial banks charge a penalty (about 5,000 Ugandan shillings/month) for accounts with less than the minimum balance, and the Bank of Uganda requires banks to disclose such fees to protect consumers.

Digital Service Experience

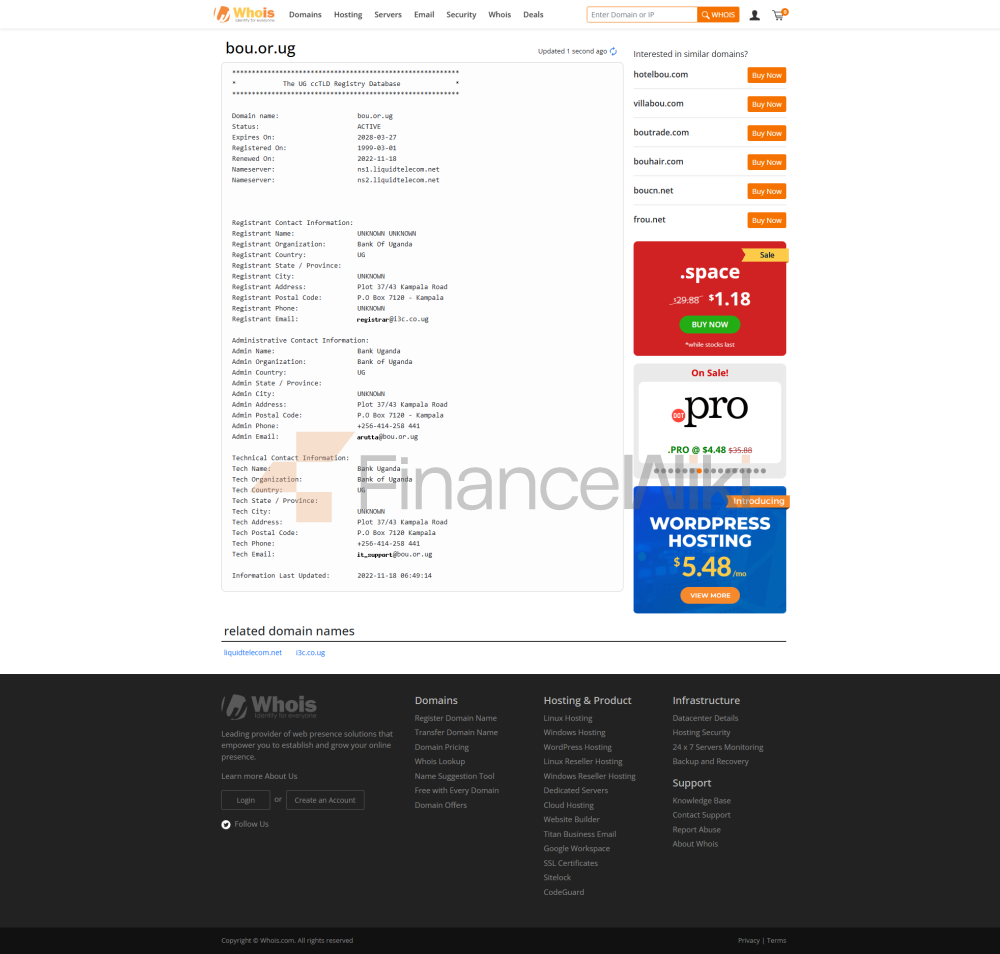

App and Online Banking: Bank of Uganda does not provide a retail banking app for the general public, but its official website (https://www.bou.or.ug) allows online access to policy, reporting and regulatory information, with a simple interface but limited functionality. Commercial banking apps, such as Bank of Africa's Mobile Wallet, offer facial recognition, real-time money transfers, and bill management, with user ratings averaging 3.5-4.0 stars on Google Play and the App Store.

Technological innovation: Bank of Uganda promotes fintech and supports Agent Banking and mobile payment platforms such as MTN Mobile Money, but does not launch AI customer service or robo-advisors of its own. Regulated open banking APIs are in the pilot phase to enhance data sharing and innovation.

Summary: Digital services are mainly implemented through commercial banks, and the role of the Bank of Uganda is to set technical standards and promote financial inclusion.

Customer Service Quality

Service Channels: Bank of Uganda provides policy advice and complaint reception via its website, phone (+256 414 258441) and social media (Twitter @BOU_Official) with responsive business hours but no 24/7 support.

Complaint handling: Complaints are mainly handled through commercial banks, and Bank of Uganda acts as a regulator to supervise the resolution of complaints, with an average processing time of about 7-14 days, and user satisfaction is medium (due to the stricter process).

Multi-language support: The official languages are English and Swahili, and some regions support local languages (e.g., Luganda), but cross-border users may rely on English to communicate.

Summary: Services are mainly based on regulatory and policy guidance, with limited direct support from the public.

Security measures

: Maximum payout of Ugandan shillings of 10,000,000 per account through the Deposit Protection Fund. Bank of Uganda requires commercial banks to adopt real-time transaction monitoring and anti-fraud technology to reduce the risk of money laundering and fraud.

Data security: Bank of Uganda follows international standards (such as ISO 27001) to manage internal data and has not reported major data breaches. Regulated commercial banks are required to submit regular cybersecurity reports to ensure the security of customer data.

Summary: Funds and data security measures are strict, in line with international standards, and suitable for security-conscious users.

Specialty Services and Differentiated

Market Segments: Bank of Uganda does not provide retail services directly, but promotes financial inclusion, such as supporting microfinance institutions to provide microloans to low-income groups and rural areas.

Green Finance: Through the Sustainability Standards Certification Scheme (SSCI), banks are required to disclose climate-related risks and support ESG investments and green loans.

High Net Worth Services: Private banking services are not provided, such services are provided by commercial banks such as Standard Chartered.

Summary: Featured services focus on financial inclusion and sustainability, and are suitable for institutional users who are concerned about social impact.

Market Position and

HonorsIndustry Ranking: As a central bank, Bank of Uganda does not participate in the ranking of commercial banks, but it regulates about 48.3 trillion Ugandan shillings (about $12.9 billion, June 2023) in assets of the Ugandan banking sector, ranking in the middle of the East African region.

Awards: Internationally recognized for its Maya Declaration of Financial Inclusion at the Global Policy Forum in 2011, there have been no recent individual awards, but its "Green Banking Policy" has been noted.

Summary: Bank of Uganda has a strong position in regional financial stability and inclusiveness, and its international reputation has steadily improved.