Basic information

about banksLietuvos Bankas is the central bank of Lithuania and is a state-owned institution, not a commercial bank or joint venture bank. As a member of the Eurosystem, it is primarily responsible for setting and implementing monetary policy and maintaining financial stability, rather than providing retail banking services directly to the public. Its role is more like that of the "conductor" of the financial system, ensuring that the economy runs smoothly. Founded on September 27, 1922, it is headquartered in Vilnius, Gedimino pr. 6)。 As a central bank, it does not have shareholders in the traditional sense, but is wholly owned by the state, not listed, and its funding is mainly dependent on state finances and the support of the euro system.

Scope

of ServicesLietuvos Bankas has a nationwide reach, but its function is focused on regulation and policy making rather than direct retail banking, so there are no offline outlets or ATMs for the general public. It indirectly influences financial services across the country by supervising financial institutions such as commercial banks and credit unions. Lietuvos Bankas also manages cash circulation in Lithuania, ensuring the supply and quality of euro currency, and has cash offices in Vilnius, Kaunas, etc., making it easy for residents to exchange currencies. In addition, it operates the Money Museum, which is free and open to the public to provide financial education.

Regulation &

ComplianceLietuvos Bankas, as Lithuania's national financial regulator, is responsible for supervising domestic banks, credit unions, payment institutions, etc. Since 2015, it has been the national competent authority in the European Banking Supervision. Lietuvos Bankas is actively involved in the deposit insurance scheme, which ensures that deposits of banks and credit unions in Lithuania are insured up to €100,000 in accordance with the EU Deposit Guarantee Directive (DGSD), up to €300,000 in exceptional cases (e.g. from the sale of a house), managed by the State Deposit and Investment Insurance Corporation. In terms of compliance records, Lietuvos Bankas is known for its strict track record, with no major breaches in recent years, and continues to promote the optimization of anti-money laundering (AML) and customer due diligence (CDD) measures.

Financial healthAs

a central bank, Lietuvos Bankas does not aim to be profitable, so financial indicators such as capital adequacy ratio, non-performing loan ratio or liquidity coverage ratio of traditional commercial banks are not applicable. Its "health" is reflected in its ability to maintain the country's financial stability. According to its official website, the Lithuanian banking sector as a whole showed strong resilience, with residential loans growing in February 2025 and loan quality improving, showing the regulatory effectiveness of Lietuvos Bankas. The central bank's assets consist mainly of foreign exchange reserves and financial instruments within the euro system, and liquidity is guaranteed by the eurozone framework with very low risk.

Deposit & Loan

ProductsLietuvos Bankas does not directly provide deposit or loan products, but indirectly influences the interest rates and product design of commercial banks by formulating monetary policy and regulatory rules. For example, it encourages responsible lending policies and ensures that products such as home loans and car loans meet consumer protection standards. Commercial banks in Lithuania (e.g. Swedbank, SEB) under their supervision offer a wide range of deposit products (the annual interest rate is usually less than 0.5% for current accounts and up to 2-3% for fixed deposits) and loan products (about 3-5% for mortgages, depending on the credit rating). Lietuvos Bankas does not interfere with specific products, but requires banks to be transparent in terms of disclosure and avoid hidden fees.

List of Common FeesSince

Lietuvos Bankas does not provide retail banking services, it does not charge fees such as account management fees, transfer fees, etc. However, commercial banks under their supervision may charge the following fees: monthly account fee (about 0-5 euros, depending on the account type), cross-border transfer fee (about 0.5-2 euros in the SEPA area, higher for international transfers), inter-bank ATM withdrawal fee (about 1-2 euros). Lietuvos Bankas requires banks to clearly disclose "hidden" fees such as minimum balance requirements, protecting consumers from opaque charges.

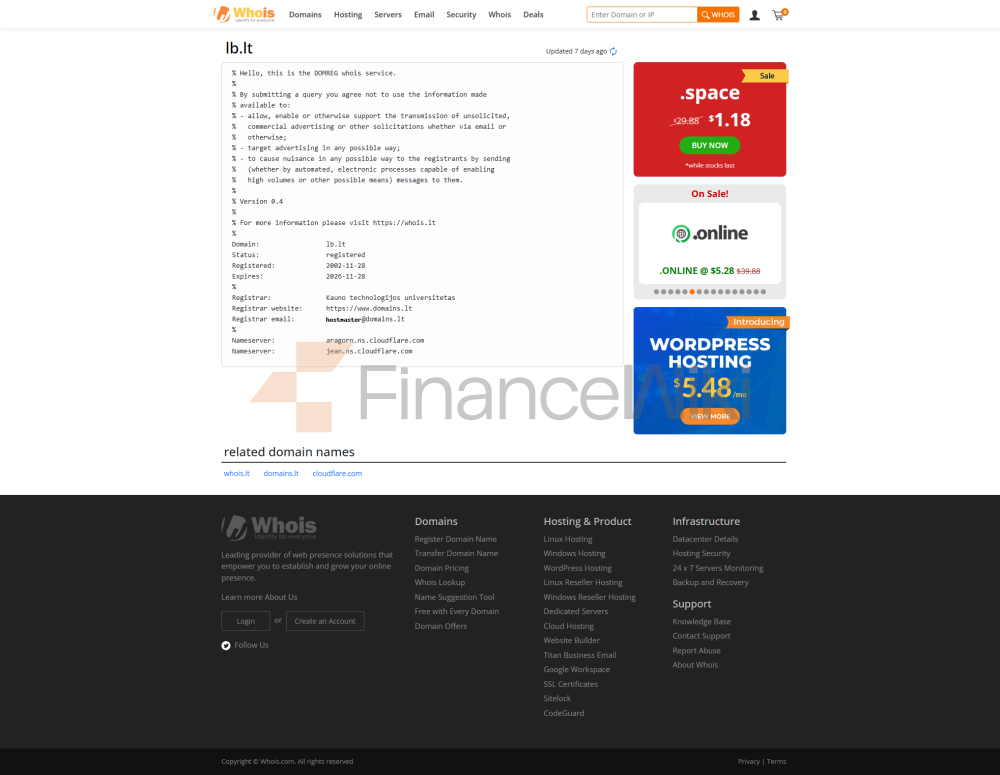

Digital Service

ExperienceLietuvos Bankas' digital services are primarily aimed at financial institutions and regulatory needs, rather than retail customers. Its official website (www.lb.lt) provides data queries, regulatory guidelines, and financial education resources, with a simple user experience but limited functionality. Lietuvos Bankas supports fintech development and operates a "Regulatory Sandbox" that helps startups test innovative products such as payment solutions and blockchain applications. It also drives the implementation of open banking APIs and facilitates Payment Services Directive (PSD2) compliance. Although not providing an app directly, Lietuvos Bankas encourages commercial banks to adopt technologies such as facial recognition and real-time money transfers to indirectly improve the digital experience.

Quality of customer

serviceLietuvos Bankas' "customers" are mainly financial institutions and government departments, and the public can contact them by phone (+370 800 50 500), email (info@lb.lt) or the official website, with a response time of 1-2 days on weekdays. It provides a 24/7 emergency contact channel to deal with incidents such as currency counterfeiting or financial fraud. In 2023, Lietuvos Bankas handled nearly 740 consumer-bank disputes, an increase of 20% year-on-year, of which 70% involved financial fraud, with an average resolution time of about 30 days and 177 settlements, showing high efficiency. In terms of multi-language support, its official website provides Lithuanian and English, and some services support Russian and Ukrainian, which is convenient for cross-border users.

Security

measuresLietuvos Bankas guarantees the safety of funds through a deposit insurance scheme covering all banks and credit unions in Lithuania with payouts of up to €100,000. It uses real-time transaction monitoring and anti-fraud technology to prevent money laundering and terrorist financing. In terms of data security, Lietuvos Bankas complies with the EU GDPR standard, and its internal systems are ISO 27001 certified, with no major data breaches recorded in recent years. As a regulator, it requires commercial banks to implement multi-factor authentication (MFA) and encrypted communication to ensure the safety of user data and funds.

Featured Services & DifferentiationLietuvos

Bankas is distinguished by its financial education and innovation support. It operates the Currency Museum, educates students and the general public about finance, and provides free guided tours. For fintech companies, Lietuvos Bankas has launched the "Newcomer Programme" to provide one-on-one regulatory advice to new entrants to Lithuania. It also supports green finance and encourages banks to develop ESG investment products, such as green bonds. Lietuvos Bankas does not provide private banking services, but ensures that high-net-worth clients have access to customized wealth management at commercial banks through regulation.

Market Position & AccoladesLietuvos

Bankas, as the central bank of Lithuania, has an irreplaceable position in the domestic financial system. It does not participate in global rankings of banks' asset size (e.g., the "Top 50 Banks in the World"), but it plays an important role in the eurozone's central banking system. In recent years, Lietuvos Bankas has been recognized by the industry for its promotion of fintech and anti-money laundering measures, such as being recognized as an important driver of the "Nordic Fintech Hub" in 2023. It also received the Academia's Vlado Jurgutis Award for the accuracy of its economic projections, such as forecasting wage growth of 10.3% and inflation of 3.1% in 2025.