Bank

of Guyana is the central bank of Guyana, established in 1965 and headquartered in Georgetown, the capital of Guyana (1 Ave of the Republic and Church St). As the country's central bank, it is wholly owned by the government and is a state-owned bank that does not involve listed or private capital. Its core functions include monetary policy formulation, financial system supervision and state foreign exchange management, rather than the retail business of traditional commercial banks.

Scope

of ServicesAs a central bank, Bank of Guyana does not have retail outlets or ATM networks, and mainly serves financial institutions and government agencies. Guyana's commercial banks, such as the Bank of Trade and Industry of Guyana, Bank de Morala, etc., offer deposits and withdrawals to the public and ATMs through networks such as Allpoint.

Regulatory & ComplianceThe

Bank of Guyana itself is the highest regulator of Guyana's financial system and is required to comply with international standards such as the Bank for International Settlements (BIS). Guyana's commercial banks are regulated by Guyana, but specific information on the country's deposit insurance system is not publicly available. In recent years, the PBOC has been more stringent in its anti-money laundering and cross-border remittance reviews, and there have been cases where manual verification was required due to false positives on the blacklist.

Financial healthAs

a central bank, its financial indicators are different from those of commercial banks, and public data is limited. However, Guyana's banking sector as a whole is driven by the oil economy (proven reserves of 11 billion barrels) and its capital adequacy ratio is relatively sound. It is important to note that the country's poor healthcare and infrastructure may indirectly affect financial stability.

Deposit and Loan ProductsThe

central bank does not directly provide personal deposit and loan services, but supervises the interest rate policy of commercial banks. The deposit interest rate of the commercial banks of Guyana is low, and the loans are mainly in the dual currency of US dollars and Guyanese dollars (GYD), and the interest rates of housing loans and car loans are affected by the central bank's benchmark, so you need to consult the local commercial banks for details.

List of common fees

Cross-border remittance fees are higher, and the SWIFT code is GUBAGYGG. Intermediary bank fees may result in a difference in the amount received (e.g. $20-$60 in the case of BEN in column 71A). Local banks charge 14% VAT on cash transactions, and credit cards are restricted to large merchants.

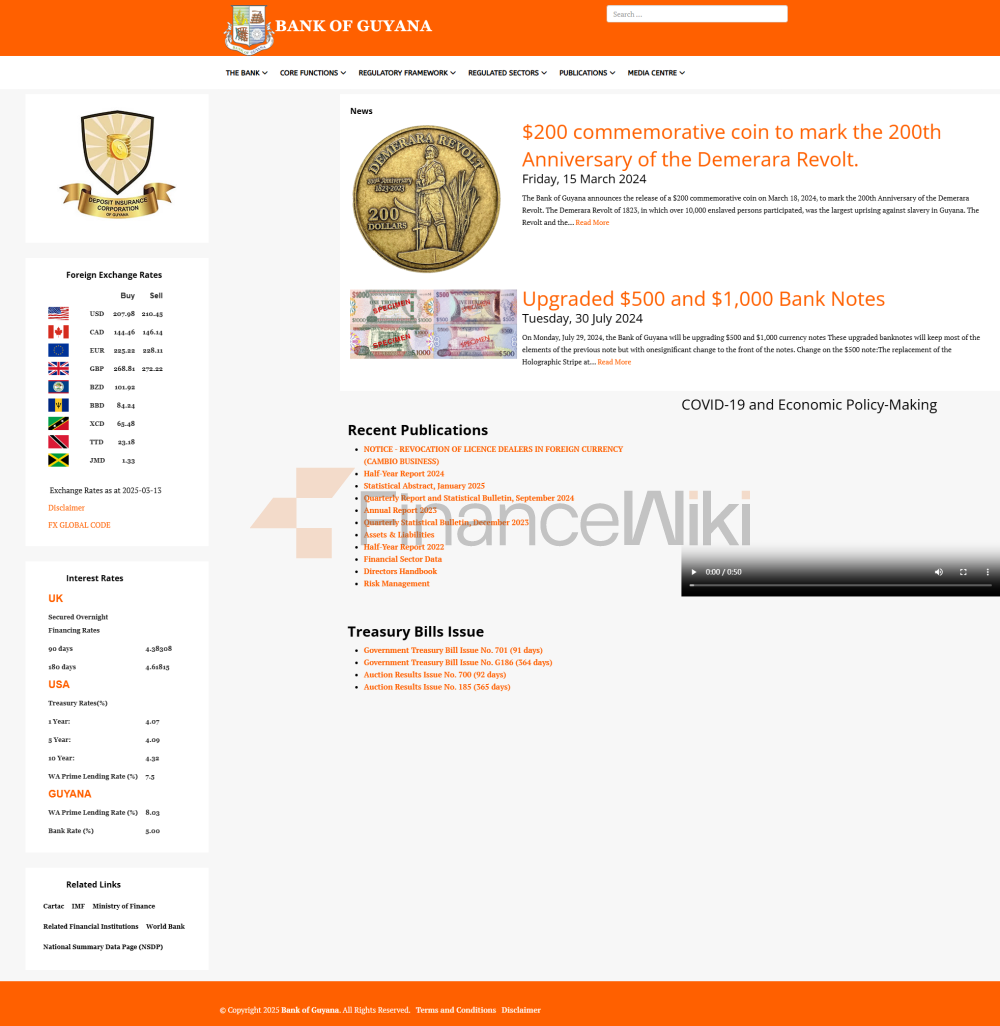

Digital service

experienceThe functions of the official website of the central bank are mainly based on policy release, and there is no retail banking APP. Guyana's commercial banks are less digitally reliant and rely heavily on cash transactions, with only some foreign banks (e.g. Scotiabank) offering basic online banking services.

Customer Service QualityThe

central bank does not provide customer service to the public, commercial banks have limited service channels, and multi-language support is weak (English only). The efficiency of complaint handling is limited by the local financial infrastructure, and it is recommended to communicate in writing.

Security

measuresThe central bank did not disclose ISO certification information, but required commercial banks to implement anti-fraud monitoring. The security of funds depends on the credit of the state, and the amount of deposit insurance is not specified. Data protection cases show that Guyana's financial institutions have been penalized for acting on behalf of customers.

Featured services and differentiationThe

central bank leads green finance policies and promotes the investment of oil revenues in sustainable development projects. Commercial banks provide export trade financing such as cane sugar and bauxite, but there are no exclusive products for students or the elderly.