The Development Bank of Uganda (UDBL) is the backbone of Uganda's financial sector and is known for its strong commitment to the country's economic and social development and innovative financing solutions. As Uganda's first development finance institution, UDBL has been committed to accelerating development in sectors such as agriculture, industry, tourism, housing and commerce through sustainable finance interventions since its establishment in 1972. The bank supports private sector projects through its five regional offices, a network of strategic partners and an advanced digital platform, serving more than 300,000 beneficiaries. UDBL has particularly strong performance in agro-ecosystems and SME financing, with a loan portfolio value of 1,670 billion UGX in 2024, a significant year-on-year increase.

UDBL was established out of the Ugandan government's long-term vision for economic development, aiming to fill the gap in the high-risk, long-term project financing of traditional commercial banks. Through targeted financial interventions, banks support projects of high socio-economic value, such as agricultural mechanization and value-added processing, industrial manufacturing, and tourism infrastructure. UDBL's digital transformation and commitment to sustainability have made it a leader in Uganda's financial markets. In 2024, the Bank was named "Regional Bank of the Year in East Africa" at the 18th edition of the African Banker Awards, highlighting its excellence in regional development finance. Whether it's providing loans to agricultural cooperatives or injecting equity investments into small and medium-sized enterprises, UDBL has earned wide recognition for its professionalism and mission-driven services.

Basic Bank Information

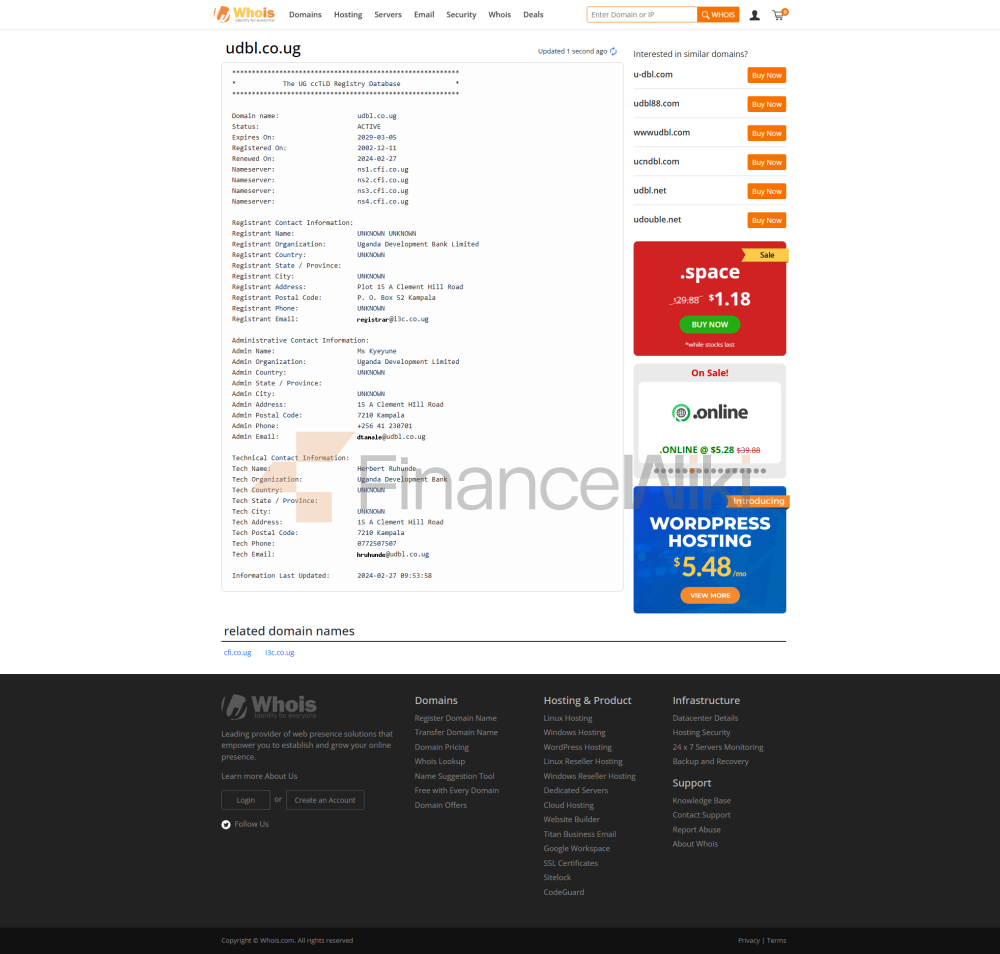

Uganda Development Bank Limited (UDBL) is a state-owned development financial institution established in 1972 under the Uganda Development Bank Act 1972 (Decree No. 23), headquartered in Kampala, Uganda, with specific address Plot No. 6 Nakasero Road, Rwenzori Towers, Wing B, 1st Floor。 UDBL is fully owned by the Government of Uganda, a private company whose shareholder is the Ministry of Finance, Planning and Economic Development of Uganda. The bank's capital structure was significantly strengthened in 2020, with the government planning to increase its equity capital from 500 billion UGX to 2 trillion UGX to support the 2020-2024 strategic plan.

UDBL's services cover the entire territory of Uganda, and as of 2024, the bank has five regional offices in Kampala, Mbarala, Gilu, Arua, and Mbale to be close to customer needs. Due to its special nature as a development bank, UDBL has a small number of physical branches (about 5) and a limited ATM network, mainly through digital channels and partners such as commercial banks and microfinance institutions. The Bank serves more than 300,000 beneficiaries of private sector enterprises, agricultural cooperatives and small and medium-sized enterprises, covering the agricultural, industrial, tourism, housing and commercial sectors. UDBL's international presence expands through partnerships with institutions such as the African Development Bank (AfDB), particularly in the areas of agricultural mechanization and value-added processing.

In terms of regulation and compliance, UDBL is strictly regulated by the Bank of Uganda (BoU) and complies with the Financial Institutions Act 2004. The bank participates in the Deposit Protection Fund of Uganda, which provides deposit protection of up to UGX of up to 10 million per depositor under the Deposit Protection Act 2016 (Act 931). There have been no significant compliance issues in the near term, and the bank passed an audit by the Ugandan Auditor General's Office in 2024, demonstrating that it maintains a strong compliance record.

Financial health

UDBL's financial performance reflects its solid position as a leading development bank in Uganda. In 2024, the value of the bank's loan portfolio reached 1,670 billion UGX (approximately US$457.2 million) and total assets amounted to 1,710 billion UGX (approximately US$468.1 million), showing strong asset growth. Although specific financial indicators such as capital adequacy ratio, non-performing loan ratio and liquidity coverage ratio are not disclosed in public information, UDBL's financial reports indicate that it meets the regulatory requirements of Bank of Uganda. In April 2024, Fitch Ratings assigned UDBL a national long-term rating of "AAA (uga)", the highest rating in Uganda's national rating system, with a stable outlook, reflecting the bank's solid capital base and low credit risk.

According to industry data, the average capital adequacy ratio of Uganda's banking sector in 2023 is 16.6%, and the non-performing loan ratio is about 4.9%. As a development bank, UDBL's capital adequacy ratio is expected to be higher than regulatory requirements (10%), and its non-performing loan ratio may be lower than the industry average, thanks to its rigorous project screening and risk management processes. In terms of liquidity, UDBL has secured sufficient liquidity through cooperation with international institutions such as the African Development Bank and the European Investment Bank, and has secured a $20 million loan from AfDB in 2024 for agricultural financing. The bank's balance sheet shows that its main assets are loans and equity investments, and its liabilities are mainly government capital injections and external borrowings, showing a healthy financial structure.

Financial Health Indicator Chart

Indicator Details Capital Adequacy Ratio Undisclosed and Expected to Meet Regulatory Requirements (10%) Non-Performing Loan Ratio Undisclosed Industry Level of About 4.9% (2023) Liquidity Coverage Ratio Undisclosed Expected to be Higher Than Industry Average Loan Portfolio 1,670 Billion UGX (2024) Total Assets 17, 10 Billion UGX (2024) National Long-Term Rating AAA (UGA), Stable Outlook (2024)

Deposit & Loan Products

UDBL offers a diverse range of deposit and loan products, with a focus on supporting projects with high socio-economic impact.

Deposits:

demand deposits: such as the current account of the enterprise, it supports Ugandan shillings (UGX), US dollars (USD), euros (EUR) and other currencies, suitable for project fund management and daily transactions, with low interest rates but high flexibility.

Fixed Deposits: Fixed Rate Savings, which offer competitive interest rates with maturities ranging from 3 months to 5 years and interest rates ranging from 1.5% to 3.0% (based on market standards), suitable for long-term savings.

Featured accounts: such as the UDBL Project Savings Account, designed for agricultural cooperatives and SMEs, with fee-free accounts and fringe benefits (such as free project consultations).

Loans:

short-term loans: 1-2 years with interest rates ranging from 8.0% to 12.0% to support seasonal financing in agriculture and working capital needs of SMEs.

Medium-term loans: with a term of 3-5 years and an interest rate from 7.5% to 11.0%, to support agricultural mechanization and the purchase of industrial equipment.

Long-term loans: with a term of 5-15 years and an interest rate ranging from 7.0% to 10.0%, to support large-scale infrastructure and tourism projects.

Equity Investment: UDBL supports high-potential enterprises through direct equity investment, with investment amounts ranging from 50 million UGX to 5 billion UGX, which is suitable for growing enterprises.

Trade Finance Loans: Support for import and export business, with interest rates ranging from 8.0% to 12.0%, and flexible repayment terms.

Bank guarantee: Provide performance guarantee and bid guarantee for enterprises, and the cost is calculated according to the guarantee amount.