Basic Information

Narodowy Bank Polski (NBP) is the central bank of Poland, not a commercial bank or joint venture bank in the traditional sense. It is entirely owned by the state and plays the role of monetary policymaker and guardian of the stability of the financial system. NBP is not engaged in retail banking, but focuses on the core financial functions of the national economy, which can be called the "heart" of the Polish economy.

Name & Background

Full name: Narodowy Bank Polski (English: National Bank of Poland).

Founded in 1945 to replace the pre-war Bank Polski, the NBP took on the role of issuing currency and stabilizing the economy in the post-war reconstruction. The head office is located in Warsaw, Poland, Świętokrzyska 11/21, 00-919 Warsaw, Poland. As a central bank, NBP has no traditional shareholder structure and is not listed, it is fully owned by the Polish government, and its independence is protected by the Constitution of the Republic of Poland and the Law on the National Bank of Poland (1997).

Scope of services

As a central bank, NBP does not directly deal with individual or corporate customers, so it does not provide retail banking services, and its "services" cover the whole of Poland, influencing the circulation of money and financial policy throughout the country. NBP does not operate offline outlets or ATMs, but coordinates monetary policy implementation and economic data collection through its headquarters in Warsaw and 10 regional branches (e.g., Krakow, Gdansk). These branches primarily serve governments and financial institutions, rather than the general public.

Regulation & Compliance

As a central bank, the NBP has a detached status and is not directly bound by traditional financial regulators, but operates in accordance with the requirements of the Polish National Bank Act and the European Union System of Central Banks (ESCB). It cooperates with the Polish Financial Supervisory Authority (KNF) to maintain financial stability, but the KNF mainly supervises commercial banks rather than NBPs. NBP does not participate in the deposit insurance program as it does not accept deposits from the public. In terms of compliance records, NBP is known for its independence and transparency, and its public annual reports and policy decisions show that it strictly adheres to laws and EU standards, and there have been no major compliance disputes in recent years.

Financial health

As a central bank, the financial health of the NBP is not measured by traditional banking metrics, but its core responsibility is to ensure the stability of the Polish zloty (PLN) and the safety of the country's foreign exchange reserves. NBP does not disclose capital adequacy ratios or non-performing loan ratios because it is not in the lending business. In terms of liquidity, the NBP manages Poland's foreign exchange reserves (about $200 billion as of 2024) and maintains liquidity coverage in the banking system through open market operations. Overall, the NBP's "healthiness" is reflected in its prudent monetary policy and international credibility, which is extremely credible.

Deposit & Loan Products

NBP does not offer deposit or loan products for the general public. It does not operate current/fixed deposit accounts and does not issue high-yield savings products or large certificates of deposit. Similarly, NBP does not provide mortgages, car loans, or personal lines of credit, and its role is to set benchmark interest rates for commercial banks (e.g., the main refinancing rate in 2025 is about 5.75%), which indirectly affects market lending conditions. Retail services such as flexible repayment options are not eligible.

List of Common Fees

Since NBP does not provide retail banking services, there are no fees such as account management fees, transfer fees, overdraft fees, or ATM withdrawal fees. The public can't open an account directly with NBP, so there are no minimum balance limits or other hidden fees.

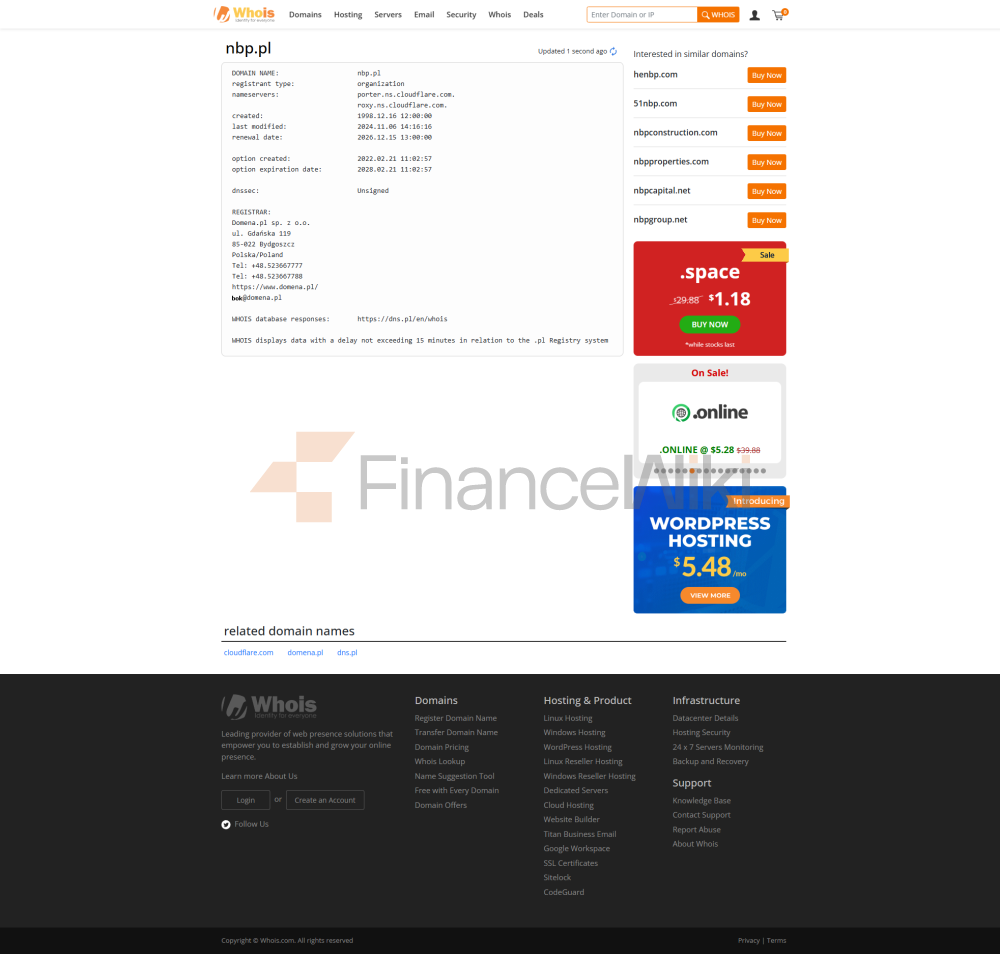

Digital Service Experience

As a central bank, NBP does not provide apps or online banking services for the public. Its official website (nbp@nbp.pl), but these channels primarily deal with policy advice rather than retail complaints. The "Contact" page of the official website lists the contact details of each department, and the response speed varies depending on the complexity of the inquiry. NBP supports Polish and English, and other non-local language services are not explicitly available. The complaint handling data is not public, but as a central bank, its policy transparency and public communication mechanism are relatively mature.

Security measures

NBP does not directly manage public deposits and therefore does not participate in the deposit insurance scheme, but the zloty currency it issues is backed by state credit and its security is beyond doubt. In terms of anti-fraud, the NBP protects against counterfeit money and financial crime by regulating payment systems and currency circulation. In terms of data security, NBP's official website and internal systems comply with the EU GDPR requirements, and although there is no clear ISO 27001 certification record, it can be speculated that it has strict security standards as a national agency. There have been no public data breaches in recent years.

Featured Services & Differentiation

NBP does not offer retail products to market segments (such as students or seniors), but it is characterized by promoting green finance and sustainable development. For example, NBP encourages commercial banks to develop green financial products by supporting ESG investment through research and policies. High-net-worth services or private banking are not applicable as NBP is not engaged in wealth management. Its "differentiation" is reflected at the macro level, such as the maintenance of preparations for Poland's accession to the eurozone and international financial cooperation.

Market Position & Accolades

As the only central bank in Poland, NBP has an irreplaceable position in the domestic financial system. Globally, it is a valued member of the European System of Central Banks (ESCB) and works closely with the European Central Bank (ECB). In terms of asset size, NBP's foreign exchange reserves and currency issuance under management rank among the world's central banks (the exact ranking varies by indicator). In recent years, NBP has received international recognition for its prudent monetary policy and innovations in digital payment systems, such as SORBET, but has not received specific awards such as "Best Digital Bank" due to its non-retail banking nature.