name and background<

ul style="list-style-type: disc" type="discfull name: The Central Bank of Nigeria

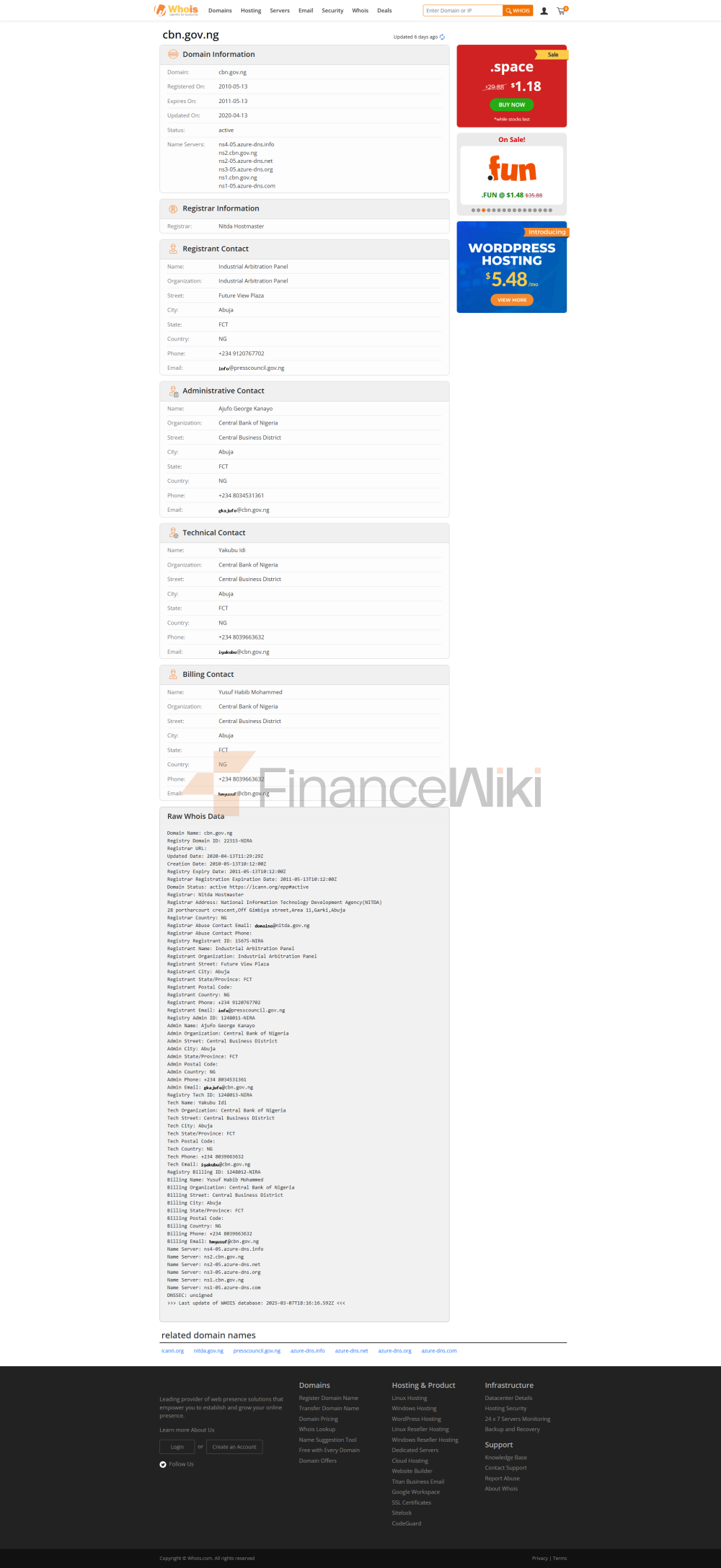

established in 1958 through the Central Bank (Nigeria) Act, commenced operations on July 1, 1959.

Headquarters: Abuja, Nigeria, 33 Abukar Tafava Baleva Avenue, Cadastral Zone, Central Business District.

Shareholder Background: Wholly owned by the Nigerian government, it is a state-owned institution and is not listed, reflecting its role as the country's financial backbone.

CBN's history dates back to the early days of Nigeria's independence, with the establishment of the Central Bank in 1958 to manage monetary and financial affairs. It was officially opened in 1959, marking the start of modern monetary policy. As Nigeria's economy has grown, the CBN's responsibilities have expanded, particularly playing a key role in financial regulation and economic stability.

service scope

CBN's services cover the whole of Nigeria and perform its duties nationwide, with its primary function being to achieve its objectives through policy and regulation.

coverage: Nigeria, as the country's central bank, its policies and regulations cover the whole country.

Number of offline outlets: CBN has branches in 36 states and the Federal Capital Territory of Nigeria, but these are primarily used for regulatory and administrative purposes rather than providing retail banking services.

CBN's role includes managing the national payment system and ensuring smooth and secure financial transactions, especially in promoting a cashless society.

services & products

as a central bank, CBN provides support to the government and the banking system. Its main services and products include:

Monetary policy: Formulating and implementing monetary policy with the goal of achieving price stability and economic growth.

Currency issuance: Responsible for the design, printing, distribution and circulation of the Nigerian Naira.

Banking supervision: Supervise commercial banks and other financial institutions to ensure that they comply with regulations and standards, and maintain the stability of the financial system.

Foreign exchange management: Manages the country's foreign exchange reserves, which have improved in 2024, indicating increased economic stability.

regulation of payment systems: to ensure the security and efficiency of national payment systems and to support the development of digital payments.

Financial inclusion: Promoting financial inclusion through policies and programs, especially in rural and underdeveloped areas.

these services are primarily aimed at the banking system and governments, rather than directly to the public, but indirectly affect the financial activities of individuals and businesses through regulation and policy.

regulatory and compliance

CBN operates under the Central Bank of Nigeria Act 2007, which confers on it a wide range of powers and responsibilities. As the regulator of the banking system, it ensures that all banks comply with the relevant regulations.

financial health

Monetary policy implementation: Maintain price stability and economic growth by adjusting interest rates and money supply.

Foreign exchange reserve management: Ensuring that the country's foreign exchange reserves are sufficient to withstand economic shocks. In 2024, Nigeria's foreign exchange reserves have improved, indicating increased economic stability.

Banking system supervision: Ensuring the stability of the banking system as a whole by supervising financial institutions.

GDP growth rate - 2.9%

inflation rate - 24.5%

digital service experience<

span style="font-family: sans-serif; color: black" > CBN launched the eNara digital currency in digital services, which is an important step to promote digital payments. eNaira is Nigeria's central bank digital currency (CBDC), which was officially launched on October 25, 2021.

User Rating: 3.55 on Google Play, based on over 9,700 reviews.

core features:

> digital currency storage: Users can store eNaira in a digital wallet.

Instant transfers: Fast transfers without the need for a traditional bank account.

bill payment: supports payment of telecommunications, utilities and other bills.

Charitable donations: Support donations to charity.

International Remittance: Supports receiving international remittances.

technological innovation: eNaira is based on blockchain technology to ensure secure and transparent transactions. CBN has also launched a fintech regulatory sandbox, which allows innovative financial products to be tested in a controlled environment. There is no explicit mention of AI customer service or open banking API support, but eNaira is a technological innovation in its own right.

> eNaira App: The eNaira Speed Wallet app is available on Google Play and Apple App Store download.

Despite its low adoption rate (less than 0.5% of users at the end of 2022), eNaira has great potential, particularly in terms of increasing financial inclusion and reducing the cost of remittances.

customer service

CBN's customer service mainly provides contact information through the official website for policy consultation and regulatory matters. Contact details include:

Address: 33 Abukar Tafawa Baleva Avenue, Central Business District, Qadast, Abuja, Federal Capital Territory, Nigeria.

Tel: +234 9 616 37 804 (switchboard).

email:

hotline: +234 8 0000 203040 (for anti-corruption and governance).

CBN's official website (Central Bank of Nigeria) provides a wide range of information, including economic data, policy updates, and regulatory guidance, for the public and researchers to use.

security measures

As a central bank, CBN is responsible for maintaining the security of the entire financial system. It ensures the safety of the banking sector and the authenticity of money by setting and implementing strict regulatory standards. Specific measures include:

payment system security: Supervise the national payment system and ensure its security and efficiency.

Anti-Money Laundering and Counter-Terrorist Financing: Enforce strict anti-money laundering and counter-terrorist financing regulations to ensure the integrity of the financial system.

Financial Education: Provide educational materials and activities to raise public awareness of financial fraud and security.

Cybersecurity: Oversee cybersecurity in the banking industry to prevent cyberattacks and data breaches.

> Currency security: Prevent counterfeiting by designing and printing bank notes with rich security features.

CBN also promotes the security of digital payments through its eNaira digital currency, ensuring transparency and traceability of transactions.

featured services and differentiation<

span style="font-family: sans-serif; color: black">As a monetary authority, the CBN has a unique function that distinguishes it from commercial banks:

Monetary policy formulation: Controlling inflation and economic growth by regulating interest rates and the money supply.

currency issuance: Responsible for the design, printing and issuance of the Nigerian naira to ensure the supply and circulation of the currency.

Banking supervision: Supervise the operations of commercial banks and other financial institutions, ensure their compliance with regulations and standards, and maintain the stability of the financial system.

Foreign exchange management: Manage the country's foreign exchange reserves and maintain exchange rate stability.

Payment System Innovation: Advancing Digital Payments and Financial Inclusion to Support the Digital Transformation of the Economy.

these features reflect CBN's central role in the nation's economy, particularly in promoting economic stability and financial regulation.

summary

Central Bank of Nigeria is the backbone of Nigeria's financial system and is responsible for monetary policy, banking regulation, and payment system innovation. It provides digital services through its official website and the eNaira digital currency, ensuring that the public and researchers have access to economic data and reports. As a state-owned central bank, CBN's mission is to maintain economic stability and the health of the financial system, providing strong support for Nigeria's economic development. Although its services are not directly geared towards individuals or businesses, their policies and regulations directly affect the functioning of the entire financial ecosystem. In the future, CBN will continue to work to promote the stability and growth of the Nigerian economy and ensure the healthy development of the regional financial system.