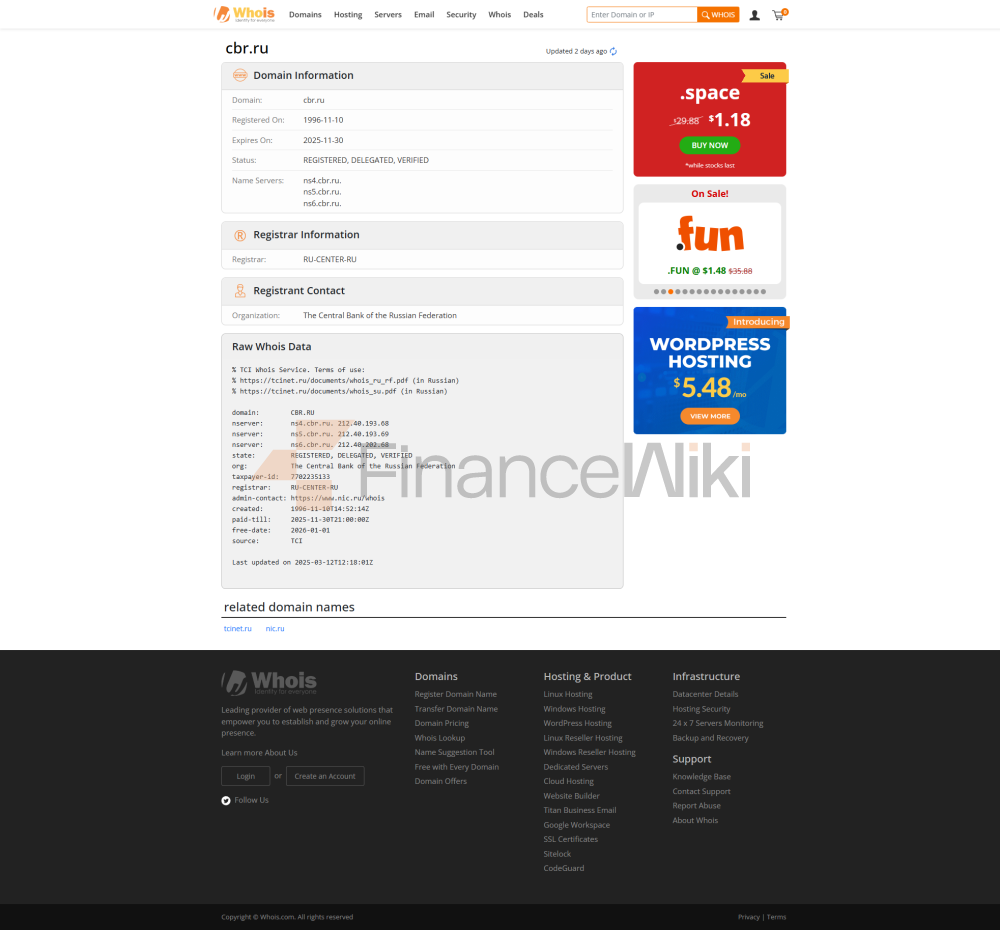

Full name and background

: Central Bank of the Russian Federation, founded in 1990, is located in Moscow, Russia. As the state central bank of Russia, it is responsible for supervising and enforcing financial policies and ensuring the stability of the country's financial system. The bank is state-owned and fully owned by the Russian government. The Central Bank was established to strengthen the independence and stability of the Russian financial system and to modernize the economy. Its shareholders are from the Russian government and are not publicly listed.

Scope

of Services: The services of the Central Bank of the Russian Federation cover the entire Russian economy and its overseas economic activities. Its main functions include managing the country's monetary policy, foreign exchange reserves, gold and silver reserves, etc., and directly influencing the global market. Although it does not have a large number of offline branches and outlets, it provides a variety of services through online platforms, partner banks and financial institutions. Domestically, its ATM network covers important cities and regions, ensuring that the basic banking needs of Russian citizens are met.

Regulation &

ComplianceAs the central bank of Russia, the CBRF is under direct supervision under the direct supervision of the Russian government. Its responsibilities are not limited to financial regulation at the national level, but also include ensuring the stability of the banking system, controlling inflation, managing the money supply, etc. The Central Bank of the Russian Federation also participates in a number of international regulatory regimes and strictly adheres to compliance requirements related to the global financial system. As for the deposit insurance program, the Bank of Russia's deposit insurance program is managed by the Russian State Deposit Insurance Corporation (DIC) and is designed to protect the interests of depositors. In recent years, the CBRF has a good track record in compliance and transparency, although some challenges may arise in exceptional economic circumstances.

of financial health

: The central bank's capital adequacy ratio is relatively high and remains at a level that meets international standards, ensuring that it is able to respond effectively to any financial risks.

Non-performing Loan Ratio: As a central bank, the CBRF is directly involved in the risk management of the banking system, so its non-performing loan ratio is tightly controlled.

Liquidity Coverage Ratio: Keeping the liquidity coverage ratio at a safe level allows central banks to respond flexibly to sudden economic crises and ensure that the money supply is not affected.

Deposits &

LoansDepositsFor

depositors, CBRF provides a series of interest rate standards, mainly through cooperation with commercial banks to set interest rates. The interest rate on its fixed deposits on the territory of Russia is usually higher than that of commercial banks in order to encourage savings. High-yield savings accounts and CDs are also very popular in Russia, especially when the state is financially sound, and savings products are more attractive.

LoansAs

a central bank, the CBRF's main function is not to directly issue commercial loans, but it affects the lending rate in the market by operating the benchmark interest rate. The interest rate and repayment flexibility of housing loans, personal loans, etc., are determined by downstream commercial banks. The policy regulation of CBRF is mainly reflected in the adjustment of market interest rates through monetary policy, which in turn affects the market interest rate level of housing loans and car loans.

List of Common

FeesCBRF itself does not charge fees such as account management fees, transfer fees, etc., but the commercial banks and financial institutions it regulates may have similar fees. The fee profile of commercial banks varies from bank to bank and usually includes hidden fees such as interbank withdrawal fees, minimum balance limits, etc. In addition, with the development of digitalization, the fees for cross-border transfers and foreign exchange transactions have gradually become the focus of market attention.

The digital service experience

APP and the digital

services of CBRF are mainly realized through cooperation with commercial banks, but its official website and online platform have high ratings, and the user interface is simple and rich in functions. Key features include real-time transfers, bill payments, and more. In terms of technological innovation, the central bank supports robo-advisors, open banking APIs and other services to further promote the development of digital finance. Through these tools, consumers can enjoy more convenient financial services.

Customer Service

Quality Service

ChannelCBRF's customer service is mainly provided through telephone support and the official website platform, and although its direct-to-consumer service is less, it ensures that all Russian citizens and businesses are able to solve problems through the banking network. Social media is responsive, and its partnership with commercial banks ensures that cross-border customers can also get quick feedback.

Complaint

HandlingCBRF's complaint handling mechanism is relatively efficient, especially in the event of a financial crisis or special policy adjustments, to ensure that public concerns can be responded to in a timely manner. Customer satisfaction is usually high, mainly reflected in the customer's recognition of financial stability and policy transparency.

Security MeasuresSecurity

of Funds

As the central bank of the country, CBRF strictly follows the financial regulations of Russia, provides deposit insurance protection, and ensures the safety of bank depositors' funds. For anti-fraud technology, CBRF and its supervised banks protect transactions and avoid fraud through real-time transaction monitoring and risk warning systems.

Data

SecurityCBRF does a very good job in terms of data security, and all online banking and financial transactions comply with the ISO 27001 certification standard. Due to its strict security protocols, there have been no major data breaches to date, and users' personal and financial data are properly protected.

Differentiated Services and Differentiated

Market SegmentsAs

a central bank, CBRF's focus is on macroeconomic regulation rather than direct provision of retail financial services, but it promotes sustainable economic development by implementing "green finance" policies and supporting ESG (environmental, social and governance) investments. Support for specific market segments is primarily at the policy level, rather than directly providing services to individuals.

The high-net-worth service

CBRF does not provide private banking services, but it indirectly supports the wealth management needs of high-net-worth individuals by regulating the country's financial system. Its policy stability and healthy development of the capital market provide a good investment environment for high-net-worth clients.

Market Position &

HonorsIndustry RankingAs

the only central bank in Russia, CBRF occupies an important position in the global financial system. It is not only one of the world's largest currency issuing banks, but also an important guarantor of global financial stability. Its assets are large and it is one of the top 50 financial institutions in the world.

The

CBRF has been named "Best Central Bank" and "Most Innovative Central Bank" around the world, especially in terms of financial policy transparency and market operations, and its innovative initiatives have provided valuable experience to other central banks around the world.