the basic information of the bank

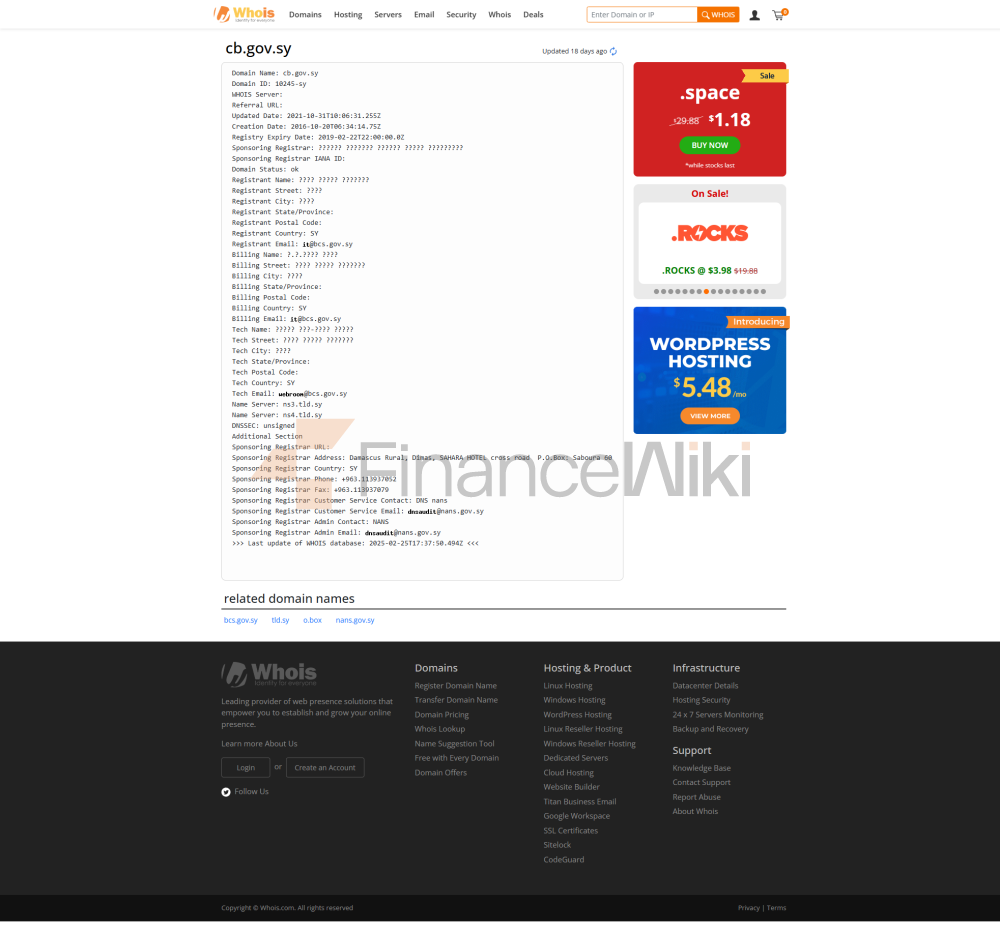

: Central Bank of Syria.

Founded: 1953.

Headquarters location: Damascus, Syria.

Shareholder Background: As a state-owned bank, the Central Bank of Syria is fully owned and controlled by the Syrian government. It is not a public company, all shareholders are government-related agencies, and the bank's policies and management are governed by the country's economic strategy and financial supervision.

Service coverage

: It mainly serves the Syrian domestic market, but due to the long-term economic sanctions faced by Syria, its international business is limited, mainly focusing on transactions with some friendly countries.

Number of offline outlets: The Central Bank of Syria has branches in major cities in the country. Although the bank has a wide coverage in Syria, there are fewer outlets in some remote areas due to the country's infrastructure constraints.

ATM distribution: The number of ATMs in banks is relatively limited, mainly concentrated in urban and commercial areas, and there are relatively few ATMs in rural or remote areas.

Regulation & ComplianceThe

Central Bank of Syria is directly supervised by the Syrian government and is supervised by the Syrian Ministry of Finance and other relevant financial regulators. As Syria faces international sanctions, banks' compliance records are complex and subject to many international standards.

Deposit Insurance Scheme: Deposit insurance schemes are not widely implemented in Syria, which makes the security of deposits a major concern in the financial markets.

Recent Compliance Record: The Central Bank of Syria has a complex record of international compliance due to economic sanctions and ongoing political turmoil in Syria. Banks have faced some challenges over transparency and financial audits over the past few years.

Capital adequacy ratio, a key indicator of financial health: The central bank of Syria has a high capital adequacy ratio, reflecting the bank's sufficient capital buffer to cope with financial market volatility. However, due to economic sanctions and unstable market conditions, the performance of capital adequacy ratios is sometimes affected by external factors.

Non-performing loan ratio: Due to the peculiarities of the domestic economic environment in Syria, banks have high non-performing loan ratios, especially during wars and economic crises, and many loans cannot be repaid on time.

Liquidity Coverage Ratio: The Central Bank of Syria's liquidity coverage ratio remains stable in an environment of high liquidity demand, but this indicator fluctuates from time to time as the political situation changes.

Deposit and Loan

ProductsDemand

Deposit Rates: The Central Bank of Syria offers low demand deposit rates, which are usually lower than those in other developing countries.

Term deposit rates: Banks offer relatively high fixed deposit rates to attract more depositors, but real returns are often challenged due to inflation.

High-yield savings accounts and CDs: Banks have launched a number of CDs products for high-net-worth customers, which offer relatively favorable interest rates and provide depositors with more stable income.

Loans

: The Central Bank of Syria offers mortgages with higher interest rates and often require stricter security conditions. Due to the particularity of the country's economic situation, it is also difficult to approve housing loans.

Car loans: Car loan interest rates are competitive, but they usually have higher thresholds and shorter repayment periods.

Personal Line of Credit: Personal Line of Credit products are few and require a high level of credit assessment and financial stability.

Flexible repayment options: Although banks offer some repayment flexibility options, these options are not often widely used due to the economic situation in Syria.

List of common fees

Account management fees: The Central Bank of Syria has relatively low account management fees, but for high-end clients, some additional fees may be charged.

Transfer fees: Domestic transfers are cheaper, but cross-border transfers are more expensive and may be subject to sanctions and exchange rate fluctuations.

Overdraft Fees vs. ATM Interbank Withdrawal Fees: Overdraft fees and ATM interbank withdrawal fees are relatively high, especially in the context of foreign exchange restrictions.

Hidden fees: Due to the minimum balance requirement for deposits, some accounts may charge hidden fees, especially for low balance account users.

Digital Service Experience

APP and Online BankingThe

mobile banking and online banking services of the Central Bank of Syria are gradually evolving, but there is still a technological gap compared to international standards. The app has low user ratings, relatively simple features, and core features include account management and transfers.

Technological innovation: At present, banks are not widely using AI technology or robo-advisors, and there is a lack of support for open banking APIs.

Customer Service Quality

Service ChannelsThe

Central Bank of Syria offers round-the-clock telephone support and limited online customer service channels. However, due to resource constraints, customer service is slow to respond, and users often complain about inefficient resolution of issues.

Complaint handling: Complaints take longer and are generally less satisfied, especially when it comes to complex matters, and customers often have to wait a long time to get a response.

Multilingual support: Due to the Syrian language environment, banking services are mainly focused in Arabic and support for non-local customers is limited.

Security MeasuresFunds

SecurityAlthough banks provide some deposit insurance protection in China, the safety of funds is often questioned due to the lack of a comprehensive international insurance program.

Data security: The Central Bank of Syria has invested in data security, but it is still not ISO 27001 certified, and there have been a number of data breaches that have further affected user trust.

Featured Services & Differentiated

SegmentsBanks

do not offer exclusive services for specific groups, such as student accounts or financial services for seniors.

Green financial products: Due to the economic situation in Syria, the development of green financial products is relatively lagging behind, and banks have not yet made a breakthrough in this regard.

High-net-worth services: Although banks provide some private banking services, their customized financial solutions for high-net-worth clients are relatively basic and lack diversity.