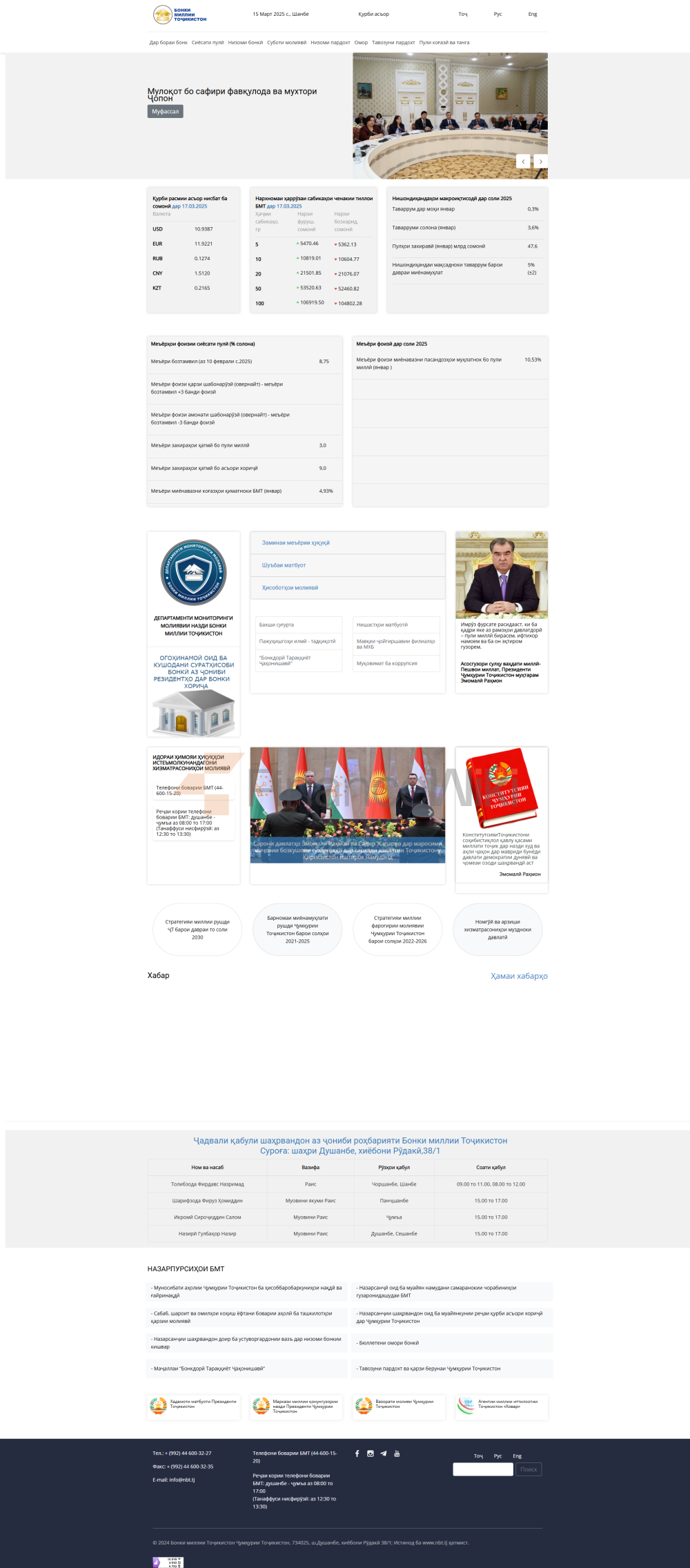

National

Bank of Tajikistan (NBT) is the central bank of Tajikistan, founded in 1991 and headquartered in Dushanbe, the capital of the country, wholly owned by the state, and headquartered in Dushanbe. As a national bank, its main responsibilities include currency issuance, financial regulation, and monetary policy making, rather than the retail business of traditional commercial banks. NBT does not involve a listing or joint venture background, is fully subordinate to the Government of the Republic of Tajikistan and is accountable to the lower house of parliament, but legally remains independent and free from administrative interference.

Scope of ServicesAs

a central bank, NBT's main responsibilities include:

formulating and implementing national monetary policy;

the issuance and management of the national currency, somoni (TJS);

supervising and supervising commercial banks and other financial institutions;

Manage the country's foreign exchange reserves and payment system.

NBT has a number of regional branches across the country, including Khorog, Khujand, Kurgan Chobe, and Kulob, to ensure that its policies and services are covered across the country.

Regulation & ComplianceAs

the central bank of Tajikistan, the NBT itself is the highest body of financial supervision in the country, responsible for formulating and implementing financial regulatory policies. In addition, NBT is a member of the Alliance for Financial Inclusion, which is dedicated to promoting access to and access to financial services.

Financial healthAs

of 2025, NBT's foreign exchange reserves are about $1.482 billion, demonstrating its ability to maintain the country's financial stability. As a central bank, NBT is not directly involved in the assessment of commercial banks' capital adequacy ratio, non-performing loan ratio or liquidity coverage ratio, but the policies and regulatory measures it formulates play a key role in the healthy functioning of the entire banking system.

Deposit & Loan ProductsAs

a central bank, NBT does not provide deposit or loan products directly to the public. Its main responsibility is to ensure the stability and efficiency of the financial market by formulating policies and regulatory measures to influence the deposit and loan interest rates and product structure of commercial banks.

List of Common

FeesNBT does not charge the public fees such as account management fees, transfer fees, or ATM withdrawal fees. These fees are usually set and charged by commercial banks. The role of the NBT is to monitor the reasonableness of these fees and to prevent financial institutions from charging consumers improperly.

Digital Service

ExperienceNBT is committed to promoting the digital transformation of the country's financial system and improving the efficiency and security of the payment system. Although NBT itself does not provide a mobile app or online banking services for the general public, its policies and standards guide the digital services of commercial banks.

Customer Service

QualityNBT mainly cooperates with government agencies, financial institutions, and international organizations, and does not directly provide services to individual customers. Its customer service is mainly reflected in policy transparency, timeliness of information release, and guidance and support for financial institutions.

Security

measuresNBT plays a central role in safeguarding the country's financial security, including:

managing and protecting the country's foreign exchange reserves;

developing anti-money laundering and counter-terrorism financing policies;

Oversee risk management and internal controls of financial institutions.

In addition, NBT cooperates with international organizations to introduce advanced technologies and standards to improve the security and stability of the country's financial system.

Featured Services & DifferentiationNBT

has taken a number of measures to promote financial inclusion, such as:

to support the development of microfinance institutions and promote the availability of financing for small and micro enterprises and low-income groups;

promote financial education and improve the financial literacy of the public;

Encourage green finance and support the financing of sustainable development projects.

Market Position and HonorAs

the central bank of Tajikistan, NBT is at the core of the country's financial system, responsible for formulating and implementing monetary policy and maintaining financial stability. It has made remarkable achievements in promoting financial reform, promoting economic development and strengthening international cooperation, and has won wide recognition at home and abroad.