Basic Bank Information

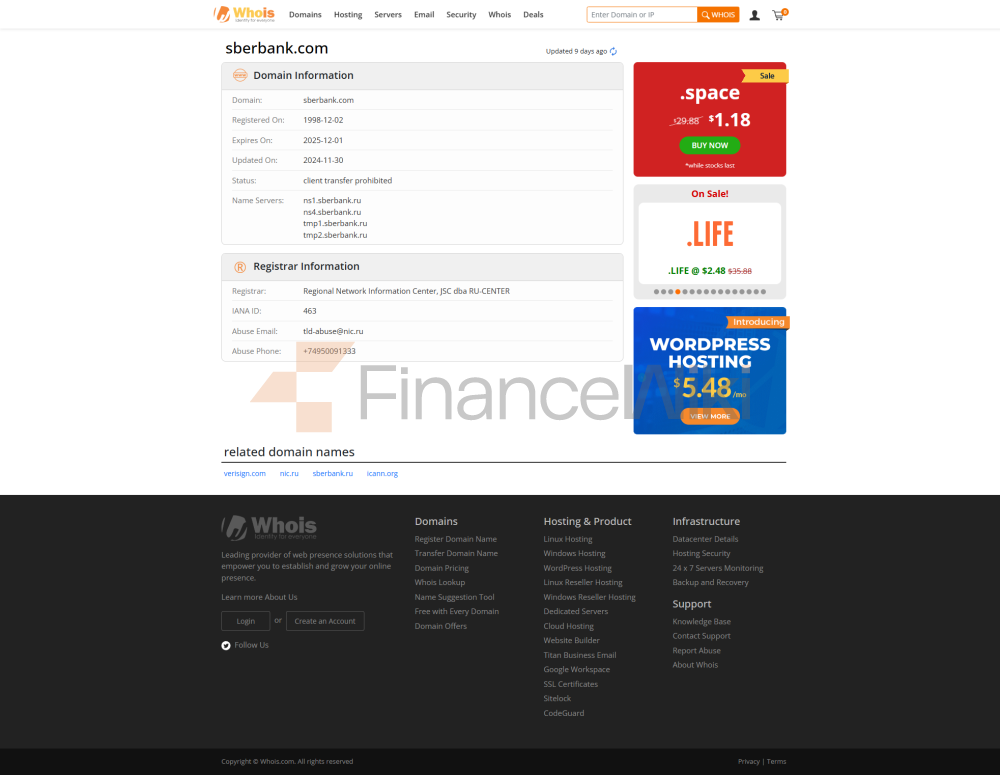

PJSC Sberbank (full name: Public Joint Stock Company Sberbank) is a Russian state-controlled public limited company, founded in 1841 as a savings bank of the Russian Empire, reorganized into a modern banking form in 1991, headquartered in Moscow, Russia (Sberbank City). In its shareholding structure, the Russian State Wealth Fund holds 50%+1 shares, and the remaining shares are publicly traded on the Moscow Exchange under the ticker symbol SBER. Sberbank is a bank authorized by the Russian government to specifically support state programs in the agricultural and industrial complex, while dominating the retail and corporate financial services sectors.

Sberbank provides services throughout Russia and 22 countries, including the CIS countries, Central and Eastern Europe, Turkey, India and China. It has the largest branch network in Russia, with 86 branches and 1 overseas representative office in 79 regions of Russia as of 2022, and a widely distributed ATM network to provide customers with convenient cash deposit and withdrawal services. Sberbank serves more than 140 million individual customers and 1 million corporate customers, covering all areas of retail and corporate finance.

In terms of regulation and compliance, Sberbank is strictly supervised by the Central Bank of Russia, which ensures that its operations comply with national financial regulations. Russia's deposit insurance system provides protection for customer deposits, and Sberbank participates as a major bank to provide additional protection for the safety of customer funds. While there have been no recent major compliance issues, Sberbank's international operations have been limited due to international sanctions, and clients need to keep an eye on them.

Financial health

Sberbank's financial performance reflects its solid position as Russia's largest bank. As of December 2024, its total capital adequacy ratio (N1.0) was 12.9%, with its core Tier 1 capital adequacy ratio (N1.1) and Tier 1 capital adequacy ratio (N1.2) being 11.0% and 11.3%, respectively. These indicators point to the bank's solid performance in terms of capital reserves, although it falls short of its target of 13.3% of the Group's total capital adequacy ratio (N20.0). Specific data on the non-performing loan ratio and liquidity coverage ratio are not disclosed, but according to its record net profit of 1.56 trillion rubles (about $15.22 billion) in 2024, it shows strong profitability and risk management capabilities. However, international sanctions and uncertainty in Russia's economic environment could pose a challenge to its financial health. In 2024, the Bank of Russia's high interest rate policy (21% by the end of the year) has boosted banks' net interest margins, but has also led to a slowdown in loan growth. When choosing Sberbank, customers should consider a combination of their financial stability and external economic factors.

Deposit & Loan Products

Sberbank offers a wide range of deposit products, including demand deposits, term deposits, high-yield savings accounts and large certificates of deposit (CDs). Deposit products support multiple currencies such as the Russian ruble and the euro, and the interest rate is dynamically adjusted according to market conditions to remain competitive. Higher interest rates are available for senior citizens (an additional 0.25% to 0.75%) and tax benefits are available for long-term deposits (more than 5 years). Customers can check the specific rates and terms through the Sberbank online platform or branches.

When it comes to lending, Sberbank offers mortgages, car loans, personal lines of credit and credit card overdrafts. The interest rate of the loan is in line with the Russian market standard, and it usually offers flexible repayment options, such as early repayment or adjustment of the repayment period. In 2024, the retail loan portfolio grew by 12.7% and the corporate loan portfolio grew by 19%, showing strong loan demand. Customers can apply for loans through bank branches or digital platforms, and the specific thresholds and conditions need to be further consulted.

List of common fees

Sberbank's fee structure includes account management fees, transfer fees, overdraft fees, and ATM interbank withdrawal fees. The fee for international transfers is 1% for online transfers, 1% to 2% for transfers through branches, and 1.5% to 5% for major currencies at the exchange rate. Other fees, such as account management fees or minimum balance requirements, should be referred to the bank's latest fee guidelines. Customers should be aware of potential hidden fees to avoid additional expenses.

Digital service experience

Sberbank's digital services are one of its core competencies, and its mobile banking app "Sberbank Online" has been well received on Google Play and the App Store, offering features such as account management, real-time transfers, bill payments, deposit opening, and support for biometric technologies such as facial recognition and fingerprint login. The app also provides useful tools such as ATM and branch locators, exchange rate lookups, and bank news. Sberbank has invested heavily in the field of artificial intelligence, developing AI customer service, robo-advisors, and open banking API support, driving the digital transformation of the Russian banking industry. In 2024, Sberbank plans to further expand its ecosystem with the launch of a car buying and owning solution, demonstrating its continued efforts in technological innovation.

Customer Service Quality

Sberbank offers a variety of customer service channels, including 24/7 phone support (+7 495 500-55-50), live chat, and social media responses (like X Platform). Its customer service team supports Russian and English, and other languages may be available in some regions, making it suitable for cross-border customers. As a large state-owned bank, Sberbank has a well-developed complaint handling mechanism, and in 2012 its customer service was nominated for "Breakthrough of the Year" by the Russian bank portal Banki.ru. Customers can submit questions or suggestions through the feedback form on the official website, and the quick response on social media also enhances the customer experience.

Security measures

Sberbank's deposits are protected by the Russian Deposit Insurance Program with an insurance amount of up to 1.4 million rubles, ensuring the safety of client funds. Using advanced anti-fraud technology, including real-time transaction monitoring and a multi-channel risk assessment system, the bank processes 4.6 billion transactions per month and detects 45 million events with a response time of just 1 millisecond. In terms of data security, Sberbank is ISO 27001 certified and implements strict information security management.

Market Position & AccoladesSberbank

is the largest bank in Russia, with a market share of one-third of the assets of the Russian banking sector in 2023 and a market share of 43.9% in private deposits. As of March 2025, its market capitalization is about $78.29 billion, making it the 236th largest company in the world (CompaniesMarketCap). Sberbank is one of the top banks in the world, having been ranked as the number one bank in Eastern Europe by The Banker magazine and ranked 51st in Forbes' "Global 2000". Its digital services have won several awards, including the 2022 iF Design Award (HR Platform Design) and several "Best Digital Bank" awards, demonstrating its leadership in the field of innovation.